Now that I got everyone caught up to my debt picture through 2023, we’ll talk about a few more things that have helped me along the way. Let’s discuss that B word that some dare not speak. BUDGET. Hopefully the other B word didn’t come to mind…

Once upon a time, I truly thought I was doing a great job maintaining my finances. I’d get a paycheck, write out my bills, and would see how much was left over for me to spend. Come January 2019, I learned…this isn’t it and I realized I was setting myself up for failure every time I got paid. Constantly waiting until my paycheck hit my account to make moves and then having nothing left before I got paid again. I was a special kind of broke. I also used grace periods for every loan I had. Car loan, you get paid before the 15 day grace period is up…Mortgage, lets inch as close to the 15th as I can get before that late fee kicks in. Everything was done according to when I got paid and I still had to move quickly or I wouldn’t be able to do what I needed/wanted. What about savings? HA! What was that?!

The biggest lesson I learned, is budgeting is having a plan for your money. A plan is best executed with pre-planning. This means, budgeting BEFORE the money hits your account.

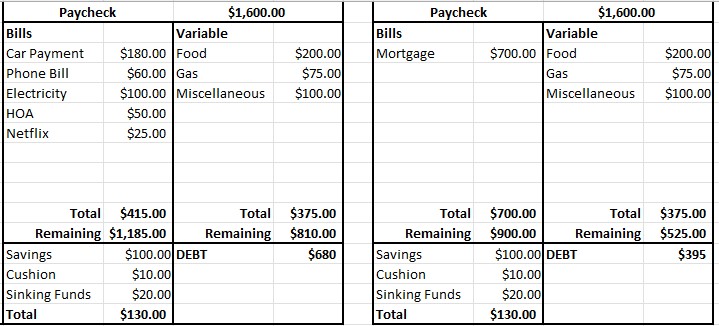

I get paid bi-weekly so typically my plan looks like this but…disclaimer: These aren’t 100% real numbers.

It’s in a Excel doc with a layout that has served me well. I have this forecasted out through December of 2025.

How it works is the Bills (top left below paycheck) are subtracted from the Paycheck amount at the top. Bills are fixed expenses with a set/similar dollar amount and/or payment date like your rent, mortgage, car payment, or utility bills. Next Variable (top right below the paycheck amount) spending (meaning it doesn’t have a set amount such as food, gas, and miscellaneous spending) is deducted. Following variable spending are Savings, Sinking Funds (expense or expenses saved over time), and checking account Cushion (bottom left). The remaining amount is how much is left to payoff Debt (bottom right). In this example, the first paycheck has an extra $680 to devote to debt and the second paycheck has an extra $395 to devote to debt.

I hope I made this sound easy. It wasn’t easy in the beginning because I had to understand the paycheck structure I had with my job and what that meant for my bills . There was a lot of rearranging and reassigning. This took time to grasp, so have patience with yourself.

When I get my paycheck, the very first thing I do is transfer my savings and sinking funds into a high yield money market. I also, schedule my debt payment(s) to be paid. Everything else is auto-drafted from my checking account because I don’t want to get caught with my pants down. This is done by allotting what gets paid and with what paycheck just like what’s listed above. I pay every bill I have by it’s due date. I’m no longer a grace period warrior! Not budgeting before money hits your account is the number one reason, why some don’t like to have their bills set up to auto-pay from their account. Besides control of course.

The most important thing that I do is I keep track of my expenses for all of my accounts/credit cards. This helps me reel it in when I get out of control. I will always be a stress-spender in recovery and it’s important for me to see where my money is going. It even helps me to show a bill is paid even if it hasn’t hit my account.

Next, I use a cash back credit card to pay for my variable expenses throughout each pay period. I keep track of the charges and either pay the balance down/off before the next pay period and or before the statement closes. This allows me to use my credit cards carrying little to no balance. The numbers you see above for my variable spending budget are real. Variable spending allows me to think before I make my purchases. This was critical in the beginning and still is. I’ve re-adjusted it several times since 2019.

Inflation, that evil bastard, caused me to up the ante just a bit.

If you’ve read my posts making mention of excessive balance transfers, this was due to me not budgeting some expenses AND overspending. I just went nuts. You get a bit stir crazy when you’ve been doing this for as long as I have.

Here’s for cash-flowing in 2023!

Photo Credit: https://smartasset.com/financial-advisor/fixed-expenses

Leave a comment