Today is a good day to get paid!!! I’m going to break down what my plan is for this paycheck and what I’ll be spending it on. This should be relatively short because I don’t think I have any stories to tell…that’s probably a lie but humor me by reading through the post anyway. LOL!

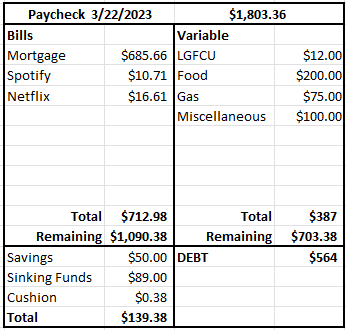

This pay period, I received $1,803.36. The bills I’ll be paying from this paycheck are as follows:

- Morgtage – $685.66

- Netflix – $16.61

- Spotify – $10.71

I’m considering buying a year’s subscription for both Netflix and Spotify to save a bit of cash and because the amounts aren’t remarkable.

For my Variable Spending I have:

- LGFCU – $12

- Food – $200

- Gas – $75

- Miscellaneous – $100

More than likely, I will not be spending money on gas because I still can’t drive with my foot being broke. Anytime I take a Lyft to a doctor’s office I pay for it using money from my HSA (Health Savings Account). Being stuck at home will reduce my spending significantly. There are a couple of things I need at home like light bulbs for the light fixtures in my kitchen and the surface light for my stove. I have no plans on hopping on a step stool to replace the bulbs but I may commission a friend to help me.

Savings

I’m putting aside $50 for Savings (My Emergency Fund) and $89 for my Sinking Funds into my high yield money market. I always leave a cushion that’s a little over $200 in my checking account. That projected $0.38 will be added to the balance of the cushion. The current balance is $207.57. I have what’s called a zero based budget. A zero based budget is where every dollar in my paycheck is accounted for. I prefer not to reduce my account to $0 just to be on the safe side, and this is why my cushion exists.

Debt

I have a total of $564 for my extra debt payment. It’s going towards my Shop Your Way Credit Card that’s at 0% interest right now. I’ll be breaking this down to pay $282 on Friday 3/24/2023 and the other $282 will be paid on 3/30/2023.

I was considering paying off my HELOC but I decided against it. I’ll be paying $200 a month until it’s paid in full. The money for this payment is coming from my travel fund. I have my reasons and will be privy to share them at a later date.

Monday, I heard from the insurance company. They’re sending me through the ringer still. I have more documentation to gather from my dentist before they’ll pay me anything or before they’ll begin processing the claim…so the wait continues. I didn’t yell this time but I’m not happy about it. The great news is I have a plan to get everything taken care of until they can get their heads on straight. More to come on that later.

I have more to share at a later time!

Photo Credits: https://eddy.com/understanding-your-pay-stub-how-to-make-sense-of-a-paycheck/

Leave a comment