This may be a hot-button topic for a few people, but I wouldn’t be true to myself if I don’t share why I no longer ascribe to Dave Ramsey’s baby steps. This post is super judgmental. But most people’s opinions can be. Keep in mind, Dave won’t be losing any sleep off my lowly blog post. Grab some popcorn, wine, a shot…whatever you’d like and I’ll get this keyboard lashing going!

Before I jump in wielding the sword, I need you to know, Dave Ramsey’s baby steps really do work. I started using the baby steps to help aid in figuring out my finances. I took a lot of his recommended tips that have helped me for the past 4 years.

So why do I not care for Dave Ramsey or his methods anymore? The first thing that made me push pause on Dave Ramsey was kind of a stupid reason but bear with me, I go into bigger issues. I don’t like how the debt free screams are facilitated. He gathers all this info, then forget him counting it down, the newly debt free person counts it down. Like…why? They just counted down to zero proverbially. Can’t there be a scoreboard or something?

The second thing that made me realize…hmmmm…was Dave’s recommendation to people to avoid doing anything that remotely resembles fun like vacation and suggests people eat beans and rice and avoid eating out. While that might be reasonable for someone who has a journey that’s less than 2 years to payoff debt, not occasionally saving up for a trip and avoiding restaurants, isn’t always a good thing to do long term. I’m single and I literally would’ve quit trying to pay this debt down, if I couldn’t take a vacation here and there or at least enjoy a dinner ever so often with my friends. Having something to look forward to has kept me from becoming burnt out. I also like decent food and enjoy going to Chick-Fil-A for breakfast when the urge calls for it. Not forgetting, my family lives out of state and I visit them at least once a year. When I took note of this, I started getting more concerned about his methods.

Number 3. Not all the financial advice he gives is sound. Just having $1,000 for an emergency starting out, isn’t enough. That’s not even enough to cover a full month of bills for me. A lot of people who follow the baby steps feel a bit lost after baby step 2 – their debt journey, ends and have absolutely no savings. Or, they end up with an emergency that costs a lot more than that measly $1k they saved up. The thing that really bothers me, is he states credit scores are not necessary, that you should find a mortgager who doesn’t use credit scores, your mortgage should only have a 15-year term, and you should close your credit card accounts? You sir, sit on a thrown of lies. Thumbs down, do not recommend. If most of the general public were to obtain a 15-yr mortgage, that would be outside of the 25% net rule for housing that he endorses. If you’ve looked at the homes and their interest rates lately, you’d have to bring home roughly $9,200 net pay a month for a home that costs $250k. And good luck finding a mortgage lender who doesn’t use credit scores.

Going even further, number 4. Dave doesn’t recommend you roll debts into a personal loan. Not following this advice, literally saved me thousands of dollars in interest. While this is on the list, I don’t recommend you roll high interest debts into a personal loan if you’ll continue using the credit card frivolously. DO NOT use the card again or pay it off every month.

Number 5. I absolutely despise his tough love approach and hate how he interacts with those who really needed help. That may have worked at one point in time and for some people but if I ask anyone for help…I’m not going to take kindly to you calling me stupid because I already have that covered. Not to mention, he can be very short, and very rude to people. Maybe it’s poor editing, but it seems like a personality flaw based on all of the footage I’ve watched…

Number 6 , the setup for his…enterprise, is illegal. The people who work for Ramsey Solutions have to be Christian, can’t have extra marital affairs (hello Chris Hogan), and will be fired if they conceive a baby out of wedlock, among other requirements. I mentioned I work for a credit union and they don’t get that deep into my personal business even when I’m applying for a loan. If you don’t believe this is going on, Google all of the crazy things Ramsey Solutions employees were fired for based on their “righteous living policy”. I’m surprised he hasn’t had the pants sued off of him.

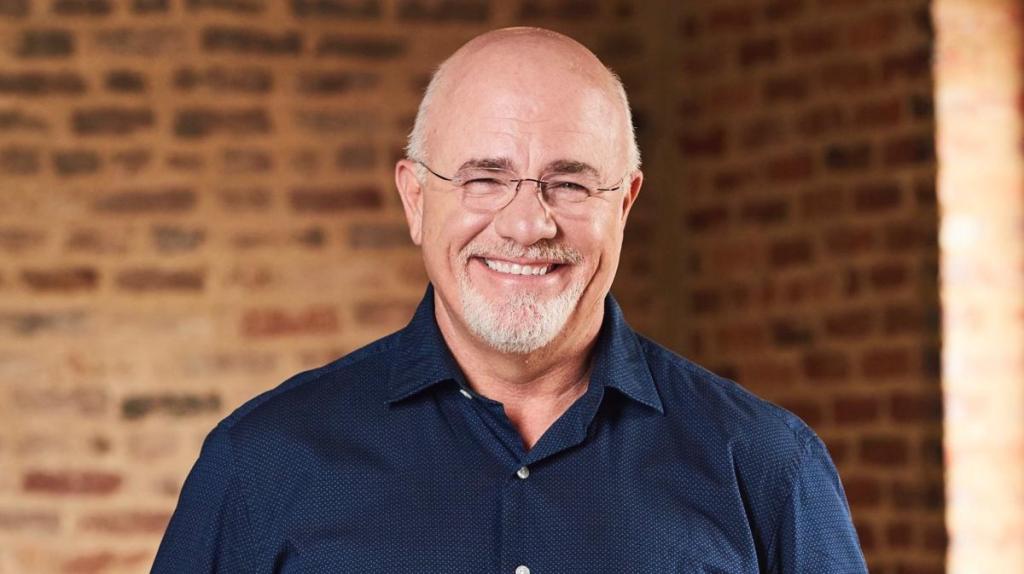

Speaking of pants and other articles of clothing…Did you know, Dave Ramsey’s net worth is $200,000,000? That is an ungodly amount of zero’s. Which brings me to point number 7. Dave cannot relate to majority of his audience, because he hasn’t had to endure a real financial struggle. Yes, he did file for bankruptcy in his 20’s, but he also was making a quarter of a million dollars annually. IN HIS 20’S! He had to file bankruptcy because of some bad business deals he made. Not because his mother was on drugs and he had to care for his siblings. Here I was barely scrapping by at $12/hr in my 20’s. Sometimes $13 an hour. Things are better for me now but I’d like to see him walk a mile in the shoes of someone one who isn’t as fortunate as he is…

I have a slight fear the commissioners of Uncle Dave’s army will come by and blow up my comments section to tell me how wrong I am. Just like their fearless leader does his “Financial Peace University” patrons. But frankly…I don’t care.

The best part of it all is there are more budgeting methods out there to help us all in our journey to financial freedom than the every dollar app. Please don’t let yourself feel stuck. Keep searching for the method that suits your financial needs. Remember…personal finance is personal. If you’d like to say something, feel free to leave a comment!

My next post won’t be me bashing anyone else…except maybe an ex…ah well! I’ll see you next time.

Photo Credits: https://julieroys.com/ramsey-good-ole-boy-evangelical-complex/

Leave a comment