A lot of us who are debt conscious have a big question: Should I finance or pay cash for a high-cost item? The goal is to try to answer that question by the end of this post. Grab a snack, a glass of water, a beer, whatever you choose and we’ll get started!

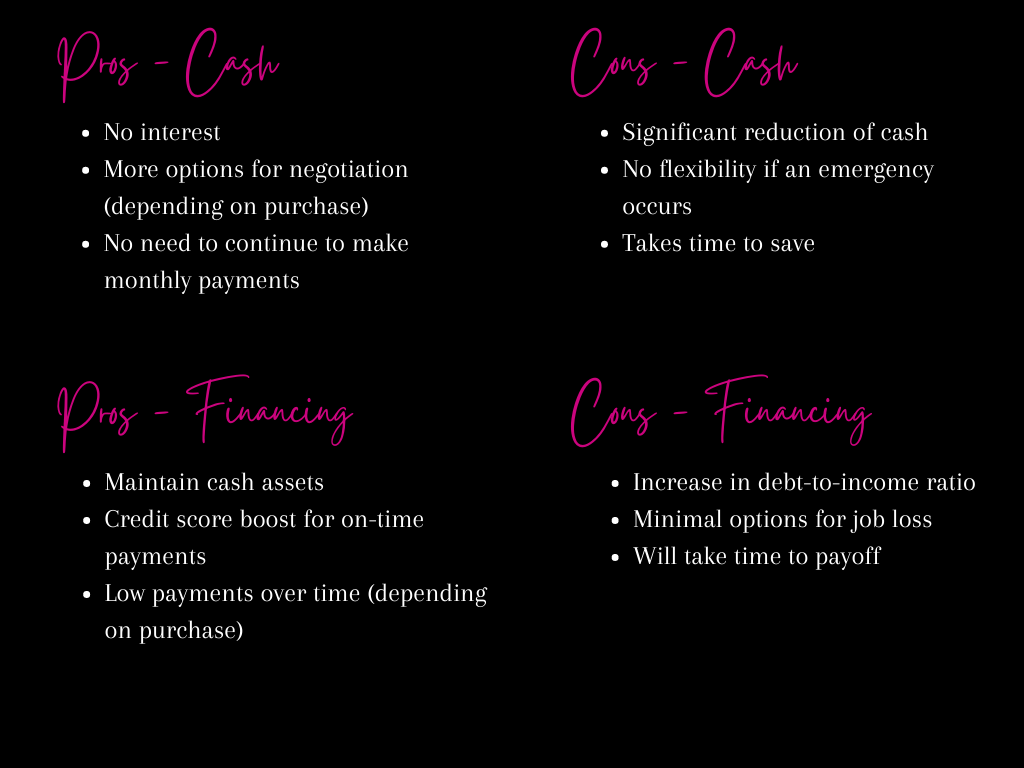

You may have been wondering if you should drop a stacks of cash on major purchases. The answer is…it depends. Yeah, I know that’s a vague answer but it’s for a very good reason. So let’s make a pros and cons list to see if you should finance or pay cash for your next big purchase:

Is the picture still a little foggy? Great! That means I did my job. With the pros and cons for both, there is a bit of an overlap but I’m going to paint a picture.

Most wealthy people find a healthy way of leveraging debt. They maintain their high account balances and invest, while making monthly payments. This means, they don’t deplete their funds to make large purchases. This allows their money, to make more money. Meanwhile, us middle-class folks take loans out on weird things that don’t have a guaranteed rate of return like… credit cards and education. I threw myself straight under the bus on that one.

For someone like myself who isn’t rich and hasn’t has the opportunity to save up for the home improvements, would you think I’m going to finance or pay cash for my purchase? I for sure am going to use my HELOC to fund the upgrades. That’s even if I have the money to pay for the upgrades when they occur. I’m sure you’re dying to know why. Well…both mortgages and HELOC’s have a tax advantage based on how much interest is paid during a calendar year. Not only would saving up for home improvements take way too long but there isn’t a clear benefit with paying cash for them either.

Now let’s talk about the most loved depreciating asset. Cars. I have yet another quiz! I’m a trainer so it’s my job to test you. Would I, who will be paying off my vehicle in 2024, finance or pay cash if I needed to buy a new car 2 years after my debt free date? This one is a bit trickier. I would still finance a vehicle purchase! One thing I don’t want to do is buy a brand new car, but you never know! I also would more than likely put money down to reduce my liability. Why not do both, if it makes sense?!

I know I’m supposed to be all about getting out of debt, which I am but…like a Kardashian sized diaper butt but…there are some privileges to financing a high-cost item. If you are dead-set on never ever ever owing any type of debt again, financing will always seem like the devil in it’s fiery hell chambers if you’re presented with a choice to finance or pay cash. If this is you, I urge you to reconsider your position. That is unless, you don’t think you can obtain new debt without going crazy. Yes, we want to be financially free but money is a tool that should also be enjoyed from time to time. Nothing is more upsetting than hearing someone deprived themselves their whole lives just to save, save, and save some more without enjoying the fruits of their financial stability. You have to live a little!

Also…buy that really cute pair of shoes you’ve been wanting. Or that PS5 if you’re into gaming. You’ve saved up long enough.

This my friends, is how personal finance gets really…personal.

Photo Credit: https://www.caranddriver.com/research/a31187523/how-do-car-loans-work/

Leave a comment