It’s April 18th and time for me to close out my budget for the pay period! We’ll go over how things went for this budget. Grab a snack, grab a drink and we’ll get started.

Okay! First and foremost. I spent way more on my birthday than I should’ve. There should be an unwritten rule that you shouldn’t have to spend money on or for your birthday. Next year will be a bit different. For damage control, I’m spreading the amount over the next two paychecks instead of paying everything all at once.

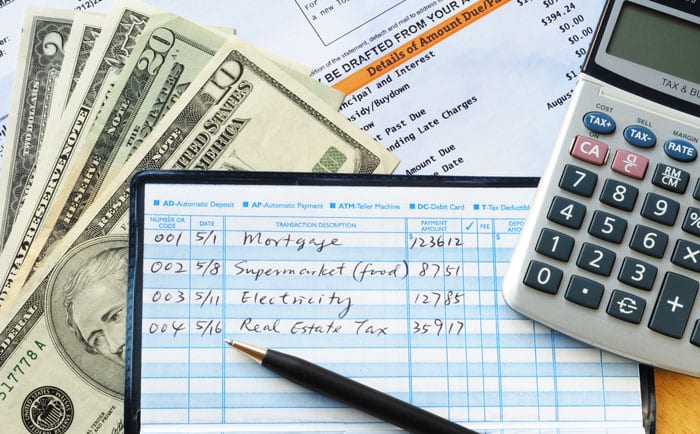

Now that that’s out the way, let’s talk numbers:

An additional $13.39 was added to my income. This is from credit card rewards. I have the Citi Double Cash Rewards card. The actual number’s for my bills were up-to-date as of my April 5th paycheck, so there were no changes there. As for my variable spending, I was technically short on my typical spending which is a good thing. I budgeted $389 total and spent $357.29. The extra amount was applied to my Care Credit Credit Card. Those rewards that I acquired went to my high yield savings account and I added the leftover $.52 to my checking account, and currently that cushion is at $208.43. I strongly recommend anyone have a checking account cushion if you do a zero based budget like I do. We’re human. Sometimes we miss charges that we expect to come out of our accounts. I like to round everything up to the next dollar and this gives that extra change I have left something to do.

By the way, April is Financial Literacy Month! Since my blog surrounds personal finance, I want to make sure I highlighted that. One of my best friends pointed it out last week and let me know what was up. I work in finance and she works in healthcare and I’m absolutely shocked that I wasn’t aware of this! And it’s during my birth month?! That makes my little math loving heart sing.

I’m going to mention 3 quick facts about finances to help with your personal finances:

- Week 1 – Judge your income against your expenses to determine if any of your financial trouble can be helped by adjusting your spending or making more money.

- Week 2 – Learn the budgeting style that suits your needs best. For example: If you don’t do well with debit/credit cards, become a cash spender in the categories you over spend.

- Week 3 – Write out all of your debts to find out just how much you owe. It stings a little but sometimes that’s what you need to have things click in your head.

Those are my quick three tips for Financial Literacy Month thus far. Please know I’ll be back with more and there are plenty of posts I’ve made surrounding financial literacy. Be sure to check those out to help you get your finances on track today.

That’s all I have regarding my finances for this paycheck. I’m ready for a clean slate and to pick things up with a new budget tomorrow.

Pro-Makeup Artist Tip:

When applying lipstick, use the side that comes to a point to apply very short quick strokes around the edges of your mouth before filling the rest of your lips in. This helps if you don’t have or don’t prefer to use liner. It allows for a more precise application.

Until next time!

Photo Credit: https://www.incharge.org/financial-literacy/budgeting-saving/how-to-make-a-budget/

Leave a comment