I missed sharing this post by two days so you get a too-fer today! The first portion will be highlighting my budget close out for my 3rd May paycheck, the second portion will be for the paycheck I received on Wednesday. Have a little grace with me. I’m going to physical therapy at $80 each visit, I’ve been working like crazy, and I started class for financial counseling all while trying to continue to maneuver through my home with a foot that sometimes doesn’t want to cooperate, a neck injury that has been flaring up more than normal, fighting double vision, trying to lose the 15 lbs I gained from sitting on my ass for the past 3 months, and adulting which I’ve decided…is a dumpster fire. I’m so lucky…Anywho, lets go ahead and unpack this post but before we do, grab your beverage of choice because it’s practically summer and we must stay hydrated and snack to wash that drink down with and we’ll get started!

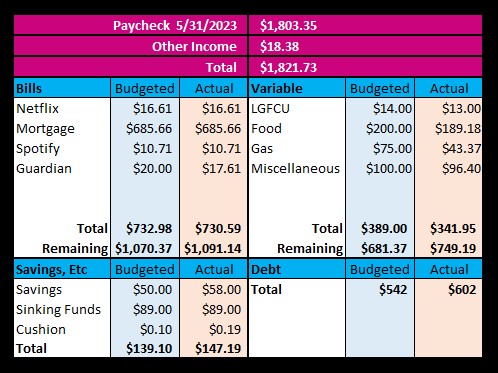

Let’s talk about how my budget went this last pay period:

Based off my personal opinion. Things went GREAT! I brought in my regular paycheck amount plus $2 in interest that accrued in my checking account, $7.95 that accrued in my Money Market, and $8.43 in rewards I accrued from Upside. My Guardian bill (water) is the only one that had a minor adjustment, leaving an extra $3.39 in the budget. In my variable categories, even with filling up my gas tank for the first time in over 3 months, I budgeted $389 for everything and spent $341.95. In my Savings category, $50 was deposited to my Money Market along with $89 for my sinking funds. I accrued $7.95 and did a round up of $.05 so I would have an even number. Once that was all said and done, I originally had a remainder of $542 to put toward debt, but after everything was all said and done, it was a total of $602. I never just make a straight payment for these amounts. If you want to see the breakdown, check out my Money Moves Monday posts. I’m thinking of beginning to post the payment breakdowns for the month so you can see exactly how I applied them on my Money Moves Month-End posts along with all of the other things I love to share including my net worth update.

Overall, I’m super satisfied how things went with my budget. As an update, I did manage to lose $22.35 in my budget and normally I post everything a big chunk at a time. I’m planning on discontinuing that practice so that I don’t miss anything. Usually, my math works for me! I don’t know what happened this go-round but I’ll make up for it. 😊

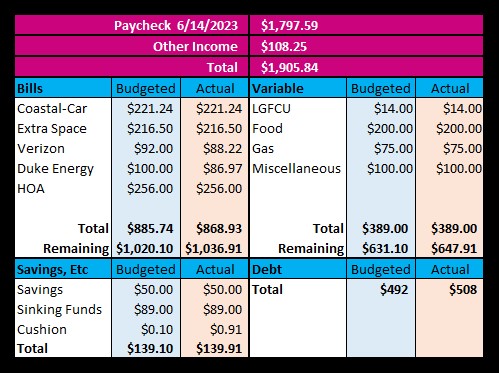

Now that we have my budget closed out, let’s talk about my plan for this pay period:

This is how my paychecks will look going forward since I opted in for accident and critical care insurance at my job. I do have my figures for my phone bill and electricity (Duke Energy) and that has made a big difference in what I’ll be paying towards my personal loan. I’m still not driving a lot and it’s been two weeks since I filled up my tank. I still have ¾ of a tank and more than likely won’t have to fill up anytime soon. I also have a knee scooter that is sitting at home collecting dust in its box that I plan on returning when I have the strength to carry a 20 lb box to a UPS store or Kohl’s. That’ll be a $77 credit back to my credit card so I’ll have a little extra to work with. It’s highly likely that I’ll use that money to buy a pair of…Crocs.

My variable categories stay pretty much the same. Mostly I’m focused on buying food to cook healthy meals at home. The savings category won’t change, and my debt already has a small difference in a positive direction. Yay me!

I do expect to be paid out a little more in interest across all my accounts, cash back will be deposited for two credit cards, and I may be collecting cash from my LGFCU account to put in my HSA while I’m going through physical therapy since the savings rate is kind of sad. I’ve got over $400 in the account and a day off on Friday that I’ll use to run a few errands.

These are my plans. Hopefully everything goes a bit well. The amount in my Money Market will likely drop if I have to continue physical therapy beyond June, but let’s hope I’m done by the end of the month. It takes so much to build up my Savings account that I just get sad when I have to drain it again!

Also! This is my 50th post since starting the blog! There’s nothing like having your finances accessible on the internet to keep you accountable. I’m hoping to gain more views but I’m definitely enjoying the ride. Thank you all for your support!

Pro-Makeup Artist/Licensed Esthetician Tip

If anything happens that is unplanned like my trip to physical therapy, it stings just as bad as a sunburn. Sunburn happens to be a common occurrence across everyone of all skin colors and types but those of us that are higher on the Fitzpatrick Scale (in other words, have a darker skin tone) are a lot less likely to develop a sunburn or skin cancer. It’s still recommended that we all wear sunscreen under the sun because both UVA & UVB rays can not only age us but also cause irreparable damage to the extent of death. To maintain your youthful appearance, moisturize regularly, and be sure to choose sunscreen that offers protection from those harmful rays. Be safe while you’re enjoying this wonderful sunshine!

That’s all I have for today! Don’t forget to like, comment, subscribe to see more content from me, and to share my page with someone who you think may benefit from the makeup tips or financial advice.

Welcome new subscribers! As soon as I hit 100 subscribers, I’ll host a giveaway. Knowing how practical I am, it’s highly likely it’ll be cash.

Until Next Time!

Photo by Katie Harp on Unsplash

Leave a comment