Happy Monday everyone! I had quite the week last week. A really great thing that happened this weekend is I caught up with someone who was a coworker when I first started working at the company I work for. We were both Tellers at the same time and I didn’t get my license until I was 26 and she used to give me rides home and she really helped me make some decisions about my personal life. What I loved most about catching up with her was it was like no time had passed even though it has been well over 10 years. I hung out with another friend and Sunday…I cleaned. It’s the cleanest my bedroom has been since before breaking my foot and I couldn’t wait to get into my bed because fresh linens always make me happy. But do I have an update for you all! Since we’re all probably sweating various body parts off, a cool snack will do you some good like some fruit and a nice beverage to wash it al down and we’ll get started!!!

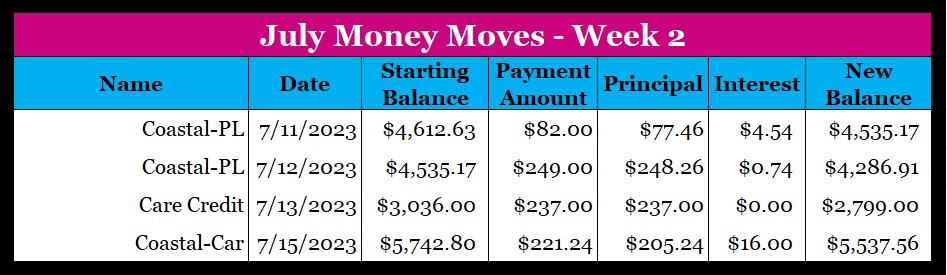

Let’s take a look at numbers from last week first. I’ve got some splaining to do:

Number 1, I’ve already made my Care Credit payment of $127 for the month. I very mistakenly tried to adjust it based on my remaining balance for PT and ended up paying an extra $237. It was a total face palm moment that I’ll try to redeem my account balance for when I get my next HSA payout in October. Yay…until then, I may use my buffer, or I may take a little out of my Money Market. Number 2, this does give me a bit of an advantage going forward and I have decided to only make the minimum payment towards Care Credit until I start the payoff plan for it on November 1st. Number 3, it’ll be 3 payments and I’ve upped the amount I’ll be applying an additional $7 to my Shop Your Way credit card when I start paying it in August. 😊

With my massive payment mistake, let’s take a look at my new debt totals:

Yet ANOTHER milestone!!! I’m below $22k and as long as I stick to the plan, I’ll be below $21k! Thank you, massive mistake! It was going to happen eventually but I didn’t think it would be this quickly. To compare this week’s progress against last weeks 3M, view this post.

One final thing, I called to have my car insurance brought down. It was going up to $1,127 and it’s down to $823.33 as long as I make a one-time payment by August 4th. I save a $1,118 annually and this is just a huge accomplishment along with my debt going down below $22k!

Pro-Makeup Artist/Licensed Esthetician Tip:

As weird as this may sound, water temperature is very important when it comes to the health of your skin. When you’re showering/cleansing your face, it’s best to keep your water warm or cooler. Running hot water does have its place but it can also cause undesired dryness if used constantly. Another thing that can impact the health of your skin is how many minerals your water has in it also known as hard/soft water. Be kind to your skin!

That’s all I have for today! Don’t forget to like, comment, subscribe to see more content from me and to share my page with someone who you think may benefit from the makeup tips or financial advice.

Welcome new subscribers! As soon as I hit 100 subscribers, I’ll host a giveaway. This message will stay until I hit the goal. 😊

Until Next Time!

Photo by Katie Harp on Unsplash

Leave a comment