We made it through the entire month of August and I never even told y’all how it’s went…so I figured I would before it got too late. I also owe a post surrounding my paycheck but I’m in full-blown renovation mode at my house, my apologies for my silence. I did spend an ungodly amount on paint this week…makes me wish I would’ve just done the work myself but my leg has been hurting because of running from a spider in mid-August and I don’t exactly have the time. I have just a month left before I take the test for my financial counseling certification! I still have a ton of work to do and while I’m great at painting, I’m not very fast and I’m going to stay in my lane this time. Without further ado, grab your snack and something to drink and we’ll get started!

I’ll be sharing the following the Money Moves Month-End for August:

- Income

- Debt Totals

- Payment Breakdown

- Net Worth

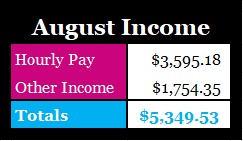

Income – August

This was an above average month for my income beyond my regular paycheck because I sold my Nissan Rogue (1,448.44 + my loan paid off), I did a favor for two friends ($80), I cashed in some rewards for Citi Card ($64.38), Ibotta ($23.61), and Discover ($16.83). Last I accrued a little interest, $2.91 in my checking and $9.18 in my Money Market. I also received $109 from my storage unit mate.

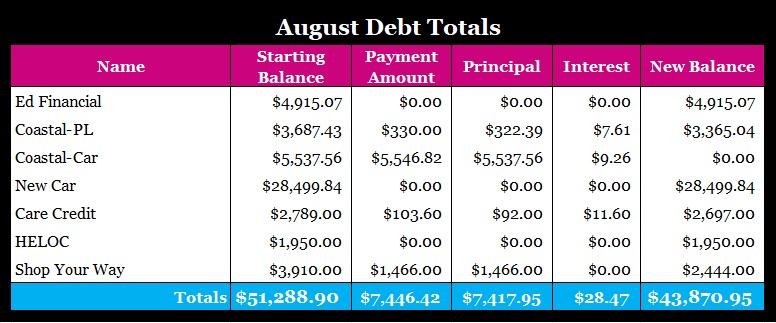

Debt Totals – August

This is what my debt is looking about for the month of August. This number will change because of the improvements I’m making this month. If I didn’t have my financial sh*t together I might lose it. In the grand scheme of things, this is normally something I’d payoff in a very short amount of time and I’m not worried about it like I was with my newish car. 😊

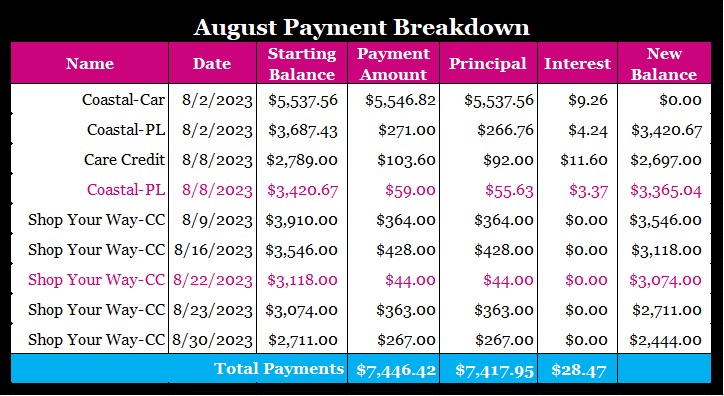

Payment Breakdown – August

Thanks to selling the Rogue, I made a ton of progress with my current debt and I’m so proud of myself. 😊

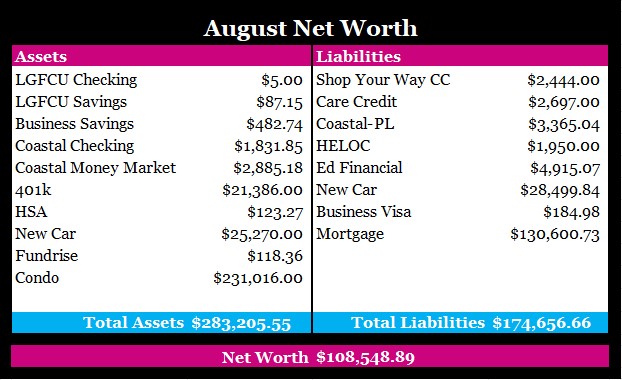

My Net Worth

This is what my net worth looks like for the month of August:

This is my 4th month with a net worth above $100k! I hope the momentum continues but at a moment’s notice anything can happen. I’ll be even more excited when I have my $10-$15k emergency fund together. My little $2k-$3k isn’t going to cut it in the long run but I do have a few different cushions I can land on should something happen.

I can’t stress this enough. Please don’t deprive yourself of things you want during your debt free journey. Deprivation can lead to over consumption. I would’ve loved to start my home projects when I became debt free but I made a judgment call that I don’t regret to scratch my itch. I don’t buy lots of clothes and shoes anymore. My home on the other hand is not only where I live where I want to be comfortable but it’s also an investment. It’s your money and you should enjoy it. Be sure to continue to be responsible over what you have. 😊

Pro-Makeup Artist/Licensed Esthetician Tip

When I was in school for esthetics, we had to keep our nails trimmed and our polish couldn’t be chipped. It was for safety and sanitation but it’s not just for budding estheticians. Keep all of your instruments clean, makeup brushes, tweezers, razors, and your hands clean because not only do we want to be sanitary but we also want to be safe and not accidentally scratch, nick, or poke ourselves with the tools we use. This will help prevent infection and breakouts.

That’s all I have for today! Don’t forget to like, comment, subscribe to see more content from me and to share my page with someone who you think may benefit from the makeup tips or financial advice.

Welcome new subscribers! As soon as I hit 100 subscribers, I’ll host a giveaway.

Until Next Time!

Photo by Jay-Pee Peña 🇵🇭 on Unsplash

Leave a comment