I may be back to my regular schedule for posting. Hopefully I won’t go too long without posting but alas…I make no promises. I hope you’re all doing well and you’re making debt your b*tch! There will be times where you won’t feel that way and that’s okay. But to recap my weekend, I’ve done a few things! I did makeup for the past two weekends. It helps me realize that I’m a makeup artist for a reason. I’ve also been really finding my groove with Ibotta. This week is a MAJOR week and I’ll tell you all way in a minute. In order to get started with today’s post, I’ll ask that you grab a snack and something to drink, pull up a chair, and get ready for a lackluster yet wild rid!

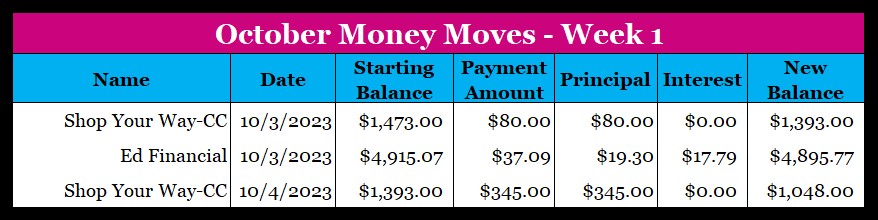

So, in honor of all 3M posts here is what my payments are looking like at this moment:

Student loans are back! Even though I make a little over $60k a year, I applied for the Income-Driven Repayment plan before we went into repayment and actually qualified. That lowered my monthly payment from $74.17 to $37.09. This will be my anticipated monthly payment until this bad boy is paid in full. I cannot wait because this is nothing like my other debts that accrue interest in the background and post it when a payment is made or compound it (credit cards). Instead, the interest gets tacked on to the loan daily. Other good news is the interest rate has not changed. For a while it did increase to 4.29% but once I changed my repayment plan and set up auto pay again, it went back down to 4.04%. I’m fully expecting to payoff my Shop Your Way credit card this month but I made a pretty great contribution so far into the new month with my first week having a total payment of $425. I’ve got no shame there…

Since I’ve had the opportunity to brief you all about my debt, let’s talk about these balances:

Before you stop and ask, ”What the f&$% happened?”, check out my most recent post that shares Where I’ve Been & September Updates. I give all the details and a glimpse into a different part of my personal life. I’m still not ready to plaster my face across the internet yet. But I hope this post makes me look just a little more human. It is a long read so feel free to pop in for the pictures and financial updates. I do encourage you read the story, because its interesting. I have to say. For me to not like drama, it certainly follows me around and I don’t like it.

And FYI…I do have a debt repayment plan for all of the debt I have a acquired between July & September so that will not be the last you hear of that!

This week, I’m doing my financial counseling certification exam! I need all the good vibes I can get because questions are never asked the same way they were written in the book. There will be a lot of process of elimination happening but I’m really hoping I pass! I have until the end of the year to pass if I don’t do well. So fingers crossed!

Pro-Makeup Artist Tip:

Fall is here!!! It is now socially acceptable to wear your deep shades of red that seem way too heavy for April through August. Bust out those wine colors! The oranges, the browns! You name it because the skies the limit! Be sure to be creative and maybe even push the limit just a smidge further. You might like it. 😉

That’s all I have for today! Don’t forget to like, comment, subscribe to see more content from me and to share my page with someone who you think may benefit from the makeup tips or financial advice.

Until Next Time!

Photo by Andrew Dawes on Unsplash

Leave a comment