I’VE GOT THE BEST NEWS! Tuesday, I passed my financial counseling certification exam! Yay me!!! I’m a little way from setting up shop but I got the biggest part done and I get to add all these letters after my name in my signature. Because weird letters that no one knows is going to be amazing to explain. LOL!!! I do think it opens up the opportunity to have more conversations. Studying gave me the insight I needed to remember about this whole thing. Thankfully I’ll be keeping the book around. There will be more developments on that later. For now, grab a snack and a sip to drink and we’re going to chat about this post I was supposed to make last week.

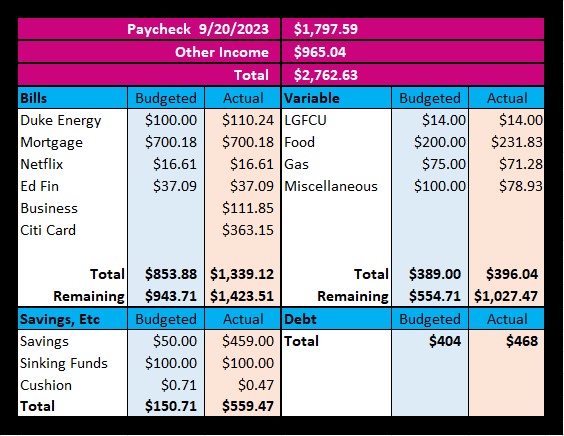

I had so much happening this paycheck and I’m going to try to shed some light on what was going on:

I like to start from the top and work my way down. It keeps me on track. My regular income was the same. I usually don’t have many big changes with it unless I do something pretty drastic at work. I don’t get much or even any overtime even though I’m hourly. As for my Other Income…I received $10.50 in interest, $9.54 in Discover Rewards. I did a favor for a friend who threw a little extra in thanks to another favor I did and that’s where $350 came from. Last, I did makeup! A friend of mine has a friend that was getting married and her makeup artist got sick! I’m sad for the makeup artist but it was nice to get back into the hustle and bustle of weddings. I did several faces and made a total of $595. All in all…a good month for income. Next my bills. I anticipated paying $100 or less on my Duke Energy bill, that did NOT happen because of energy price hikes (more on this later) and I ended up paying $110.24 for this go round. I did make up for it at least. My mortgage did go up. Usually around late August I get the notice on if my taxes and insurance increased and it did. So I went from paying $685.77 to $700.18. I did pay $200.31 for a shortage which is when my taxes and insurance payment was paid for the year but the amount paid didn’t cover the entire bill. Escrow is the equivalent to a sinking fund. I paid Netflix at $16.61 like always, paid my first student loan payment since last year for $37.09, and added two categories. One where I threw a little cash from my winnings at my business account that’s what the $111.85 is for and $363.15 for a little budgeting discrepancy that I was going to keep riding out until I had no choice but take the money from my Savings. I did have a rest so we’re good to go. Next for variable spending, I sent $14 to LGFCU, spent $231.83 on Food, $71.28 on Gas, and $78.93 in Miscellaneous spending. Next for Savings. I took most of that Other Income and put the money into my Money Market, a total of $459, $100 went to Sinking Funds, and $.47 went to my checking account cushion. Last…I made a decent contribution to my debt. This says $468 which is a little off, it was a total of $574 because I pay $100 from my HSA every month. I technically have $6 that I can’t find that I paid towards it and I’m okay with that. Whew! That was a lot.

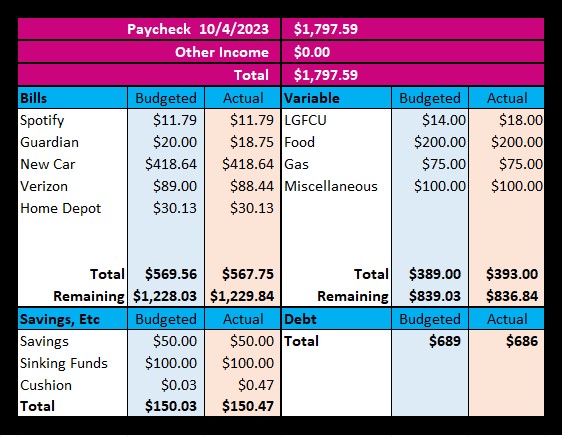

Before I get major typing fatigue, I’m going to talk about my plans this paycheck:

There’s nothing major happening with this paycheck. Spotify is at $11.79, Guardian has a budgeted amount of $20 and I paid $18.75. My car payment is almost due and has a hefty price tag of $418.64 that I just love to pay every month. Verizon is budgeted at $89 and I’ll be paying $88.44 and finally Home Depot is due at $30.13. My minimum is really $29 but I decided to knock off the change and pay $30 every month. My variable spending is the same, my savings is the same with the exception of the difference to my cushion that was budgeted at $.03 and has an actual expectation of $.47, I’ll tell you now…that’s going to change. For this paycheck, I’m looking forward to putting $686 towards debt. 😊

I’m looking forward to making some extra cash in the coming months and I’m going to do what I can to keep up the momentum. Anything I can do to make extra cash is ideal.

Pro-Makeup Artist/Licensed Esthetician Tip

Before I chatted about red concealer now, let’s talk a bit about that weird green concealer. This concealer actually cancels out redness. It’s great for any red blemishes that you just can’t cover up. Any time you color correct, you’ll want to be sure to follow it up with a full coverage foundation or concealer. Color correctors must be covered or they look absolutely crazy but we’ll always trust the process.

That’s all I have for today! Don’t forget to like, comment, subscribe to see more content from me and to share my page with someone who you think may benefit from the makeup tips or financial advice.

Until Next Time!

Photo by Brett Jordan on Unsplash

Leave a comment