Hello! At this point, I’m just coasting through October as best as I can. I didn’t have too bad of a weekend. More sleep would’ve been super nice but beggars can’t be choosy…even when they took two days off work at the end of the week that consisted of getting things together for their home. Thursday, Roto-Rooter completed the rest of the work for my house in the morning and it’s so quiet I’m still not sure what to do with the silence. I’m still barricading myself in my bedroom but I don’t feel as confined to the space as I did. In the afternoon, I actually bought a few things for myself. I needed new slippers because mine got wet thanks to the super gross toilet leak, and I decided that I would buy shoes that WEREN’T CROCS! I bought two cute pairs of Hey Dudes that seem to not piss off my foot. I also did a favor for a friend after I went and checked out this really amazing flooring company. The flooring company has this great brand they sold for flooring that I absolutely fell in love with. I just knew it would be the floor for me but I still took that floor and 3 other very large samples home with me. Friends also said…I like that flooring. Which one do you like? And what do you know…what I liked is what they also liked. It was nice to see it wasn’t the only one seeing how great of quality the floors were. I did end up choosing a warmer color when I returned the samples just to punch things up just a bit. Friday, I looked for someone who might be able to offer a solution for a new bathroom vanity. Things didn’t go super great. I found nothing but decided, it was best to stay on Wayfair. If all else fails. I may replace the hardware for the pedestal sink I currently have and just buy new storage since mine died and is buried on my porch for the insurance company to take a look at. We’ll see. Storage is the name of the game, but I really need floors. I did something else major and will tell you what that is momentarily. For now, grab yourself a drink and something to snack on and we’ll get started!

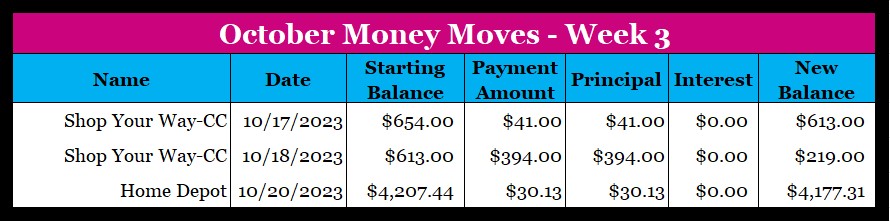

Here are the details for paying off my debt for this week:

If you look at Home Depot…it went up by A LOT. Yay…the reason for this is because I had already decided to have the flooring extended through my kitchen and my refrigerator…that old gal…leaks and leaks bad. I don’t want to ruin my new floors so I’ve went ahead and bought a new fridge. I knew I was going to have to do this very soon so this isn’t a surprise. The plan is that it’ll be my biggest purchase through this catastrophe I’ve experienced. The new fridge cost $1,386.31 and that includes the $18 installation kit, and $50 haul-away for the old gal. I do plan on buying some new light fixtures, having that bad spot in my ceiling patched above my stove, and whatever else I can think of for things that’ll be coming out of my own pocket. I’ll be updating my debt payoff plan because things are getting a bit crazy at this point. I fell all the way off the bandwagon and it’s not even because I’m spending like a psycho on frivolous things.

I may not have made more progress than additions this week but I’m still glad some of my balances are still going down and…my Shop Your Way credit card is seconds from being paid off!!! This is the lowest this balance has been in about 2 years. That’s a little light at the end of the tunnel. 😊 Check last weeks 3M post for comparison.

Keep in mind…none of this isn’t about not spending money. This is strictly about managing our money well. I’m honestly saying this for myself. There are just some things that are out of my control and I have to be okay with it. I will need/want things for myself and I don’t want to feel guilty about making the purchases. One thing I won’t do, is say I deserve something. I do deserve rest, I do deserve to keep my body healthy to live a long life, I do deserve to continue monitoring my finances and control the things I can control, and manage the things that pop-up as best as I can. Overall…I’m going to be okay and you will too! 😊 Even though it might suck bad right now…

Pro-Makeup Artist/Licensed Esthetician Tip:

I want to chat a little about emollients. I’m a chronic moisturizer. This means I lotion my hands every time I wash them. Yes…every time. When I don’t, they itch or my skin feels tight and really uncomfortable. I noticed this when I was 9 whole years old. If you’re skin looks or feels dry, try a nice rich emollient like a body butter, shea butter, a hand cream, or heavier lotion to moisturize that dry skin and it will make a world of difference, especially with the cooler months ahead of us! Dry air, leads to dry skin, dry skin leads to flaking, discomfort, and sometimes cracking and bleeding. Diabetics are more prone to dry skin that can crack and bleed and should use moisturizers approved by their Endocrinologist or a Dermatologist. This skin bag we’re given is all we’ve got! Take good care of yours!

That’s all I have for today! Don’t forget to like, comment, subscribe to see more content from me and to share my page with someone who you think may benefit from the makeup tips or financial advice.

Until Next Time!

Leave a comment