Hi All! It’s been MONTHS since I’ve been around but I’m still alive!!! I tell ya…your toilet leaking and flooding your house can really throw things off. Greatest of great news! My house is finally complete! I have floors that no longer smell like cigarette smoke and they’re oh so pretty! I feel like a real adult now. I’m still working on getting all my decor together and clearing out the extras in my guest bedrooms that I really don’t need. I’ve been trying to purge like crazy while also being social among my friends and also…dating. I hopped back onto the market and it’s nothing shy of a sh*t storm. I’ve been ghosted, trauma dumped on, insulted (which is surprisingly hard to do but was accomplished), lied to, and I’ve only been on one date. I’m starting to think online dating is not for me at all but I have no idea about where else to meet eligible single men. Sigh…Ah well… As for the not so great details, besides my non-existent prospects, is my debt. I owe a lot more and we’ll get into this story momentarily. For now, do me the true honor of grabbing a snack and something to drink and we’ll get started!

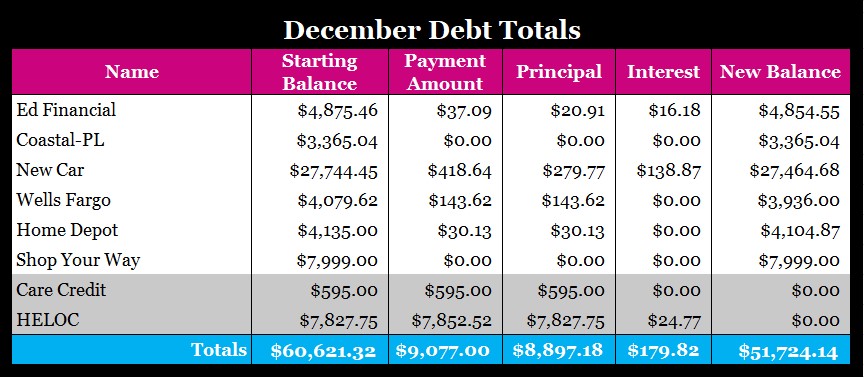

2023 has been the epitome of a rocky year for me. I’ll try to recap all my craziness on 1/1/2024. I’m steadily trying to heal from how nuts its been and reinvent myself at the same time. Here are my current debt totals and the explanation of what exactly went wrong which I’m going to let you know now, shocked the hell out of me:

First, the last two debts are paid off. I’ve officially paid off my appliances from having lock jaw from 2022 into 2023! Yay!!! I can imagine that I’ll have to do something else for these in the meantime. I also paid off my HELOC but it was in the form of a balance transfer which I’ll talk about. Ed Financial, my student loan is slowly being paid down. My personal loan isn’t budging…on purpose. The balance for my car is going down slowly but consistently. Last the sh*t hits the fan with the last 3 items. Number one. I bought a new fridge THAT I LOVE!!! And that is why my home depot credit card balance is higher. I may have made mention of this before my hiatus. The fridge was just shy of $1,400. I’m hoping it lasts for a good long while. That was expected…what I’m about to tell you…was not…

We all recall that I had to have a lot of work done on my house. Now I want to tell you, NEVER TRUST THE INSURANCE COMPANY! I planned on hiring a contractor a friend of mine recommended but the insurance company offered to let me interview a contractor that they recommended. I wanted options so I went for it…THIS WAS THE BIGGEST MISTAKE I HAVE EVER MADE!

The contactor came by that last Money Moves Monday post I made on 10/23/2023, he was nice, and extremely thorough. However, I decided to go with the contractor I originally because I was having a few extra things done unaffiliated with the insurance repair and I’d just now be getting my house repaired. The contractor I picked got started on 11/10/2023 (my deceased dad’s birthday) and finished up on 11/20/2023. Right before Thanksgiving.

Well…the contractor I didn’t pick, sent a report in to the insurance company who in turn decided, based on their report, to give me a materials budget of $2,400.78. This amount was supposed to buy all my flooring for my living room, bathroom, hallway, and utility closet, paint, mud, paint brushes, door kits (there were 3), and any other supplies I needed to purchase. The insurance company refused to change this amount. How did I find out about this very low, very obscure amount? I bought $4,500 of flooring. Sigh…The max they were offering for flooring was $3.84 a sq ft. The tile for my bathroom was $5.99 a sq ft and my luxury vinyl plank flooring was $6.53 a sq ft. All because I didn’t buy the cheap flooring from Home Depot. FML!!!

I tried to talk to my adjuster who refused to answer my emails about why the flooring budget was so low. To make matters worse, I happened to catch COVID right after the work got started and my fight was all gone. When I found this out, I had to open a credit card to pay for the flooring in the amount of $4,079.62. Looks identical to the Wells Fargo debt right? That’s because it is. The great thing about my finances is I can afford to pay for the floors and this flooring has 0% APR for the first 12-months.

In the middle of all of this, I purchased new light fixtures, bought recessed lights for my ceiling, a new bathroom mirror, and had everything installed. This did cost me quite a bit but I figured I might as well since it was in the plan anyway. My house has MUCH better lighting that it did which makes things easier for me. I paid for everything out of my HELOC and still had a balance from when I had that trash work done on my house and when my car ended up with mold. I decided to do a balance transfer from my HELOC to my Shop Your Way credit card. All of this meant I had to come up with a new debt plan with the new numbers. Now…I’m MAXED OUT.

Everything was flipped upside down but I was able to map out a plan that made sense. For now…I’m working on my Home Depot credit Card to pay the balance down to the point where I pay off my new fridge, then I’m hitting the hefty balance for the Shop Your Way credit card, after that, I’m paying down the floors, and am going back to doing the debt avalanche by paying off my personal loan, and student loans.

I have something major happening in April of 2024. This will determine my plan for everything but until then, this how I’ll be going forward. I’m looking to restart Money Moves Monday and I’ll be back to provide updates for how my debt payoff is going now.

Pro-Makeup Artist Tip:

Matte lipstick is a different beast. I’ve been wearing makeup everyday to look more polished and I’ve found a few things about matte lipstick. Number one, it’s best to moisturize your lips beforehand and wipe off the excess. Number two, use a lipliner to keep your matte lipstick from feathering. Number three, remove what you can and moisturize your lips before reapplying. Number 4 let the lipstick dry before doing anything! All four of these steps will allow for a better application.

That’s all I have for today! Don’t forget to like, comment, subscribe to see more content from me and to share my page with someone who you think may benefit from the makeup tips or financial advice.

Until Next Time!

Photo by Gabriel Meinert on Unsplash

Leave a comment