Hi and hello! I’m super proud to say that I managed to make it through 2023 with all of the off the wall things that happened. I’d so love to embrace 2024 without any abandon, but I’m entering the new year cautiously. Funny thing though…there were two more instances that 2023 had to show me it was the boss and not me. Before Christmas, I went in for a trim and left with a full-blown haircut. Dude cut like 3 inches off my hair which was a major setback because I have a goal to donate hair. So back to the drawing board for that. Next…Friday right before New Year’s…my garbage disposal decided it wanted to stop working. So now I have yet another home project to sink money into. Yay me. In comparison to how my entire year was, that wasn’t great, but it wasn’t the worst that 2023 had to offer me. The biggest pill to swallow is that I got as low as $20,839.06 with my debt and I now have over $30k more than that. I could cry real tears if I had nothing to show for either. I did buy another car and had to have new flooring installed in my house. Both are awesome. We’ll get into the breakdown for the end of December 2023 and what my life looked like. Do know that I’ve been doing my damnedest to get back on the right path. Without further ado! Let’s go grab ourselves a snack and a drink to wash away our sorrows with and we’ll get started!

I’ll be sharing the following the Money Moves Month-End for December:

- Income

- Debt Totals

- Payment Breakdown

- Net Worth

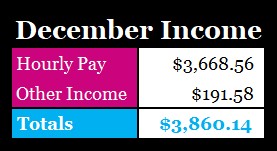

Income – December

I purposefully left out November because I got some very hefty deposits because of the work I had done on my house but this is more realistic with a few extras. I did adjust my withholdings for the end of the year and will leave it as is through February of this year and that’s why my hourly pay is higher than normal. This was a pretty good amount of extra income so I decided to provide a visual of what it all included. Here is how it was broken down:

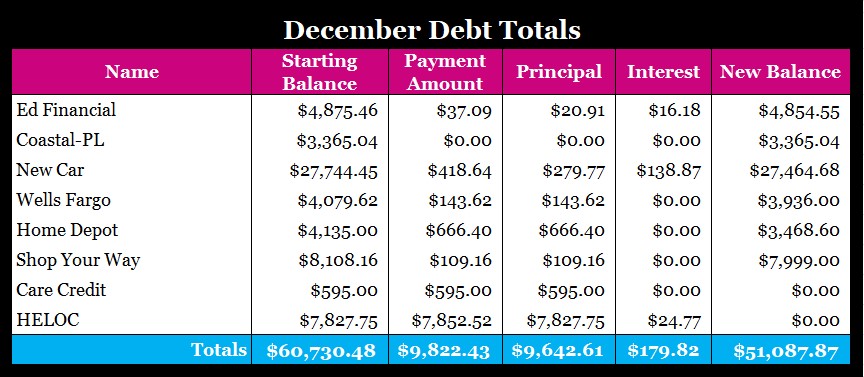

Debt Totals – December

The last time I did a Money Moves Month End post I struggled a bit because of buying my new car. I just about had a fit watching the debt increase. Well…we’ve made it to where my debt has increased some more and I’m practically back at square one when I first began my journey. I feel defeated every time I look at these numbers. I’m trying to constantly remind myself that I’m going to get out of this hole I’m in and it’s not super easy. Still have extra money left over which makes me realize I can handle what has occurred. I’m trying my hardest to stay optimistic about this because I’m just getting weary constantly dealing with all these things financially and physically by myself.

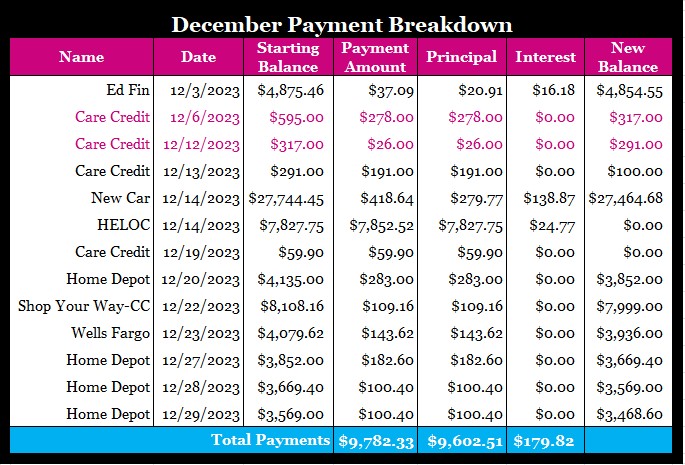

Payment Breakdown – December

I’m still making payments! No matter how upset I am about it all, I’m still doing what I must to get things resolved the best way I know how. This is what it looks like to be an adult some days. Doing what’s necessary regardless of everything that’s happening in and out of your control.

My Net Worth

My net worth isn’t too bad considering the debt hit I’ve had! I’m still doing well financially. By late spring, early summer, I should be back above $100k. I’m looking forward to being back to that place and getting more debts knocked off my list.

Pro-Makeup Artist Tip

I’ve got a super oily nose. The primer I normally use for my foundation is no longer being sold…boo! So I’ve had to change up how I apply my makeup lately. I’ve added a silicone primer back into my regimen and I’ve actually added powder. After I primer…I powder. After I put on my brows…I powder, before I apply my foundation…I powder. Then I set, and I powder again! We do what we must that works and that makes sense and that brings this entire post full circle. Here’s to semi-matte noses & t-zones in 2024!

That’s all I have for today! Keep an eye out and I’ll post my debt overview for 2023. Also! Don’t forget to like, comment, subscribe to see more content from me and to share my page with someone who you think may benefit from the makeup tips or financial advice.

Until Next Time!

Leave a comment