Guess who’s out of hibernation? While I can barely go outside without a sweater, I can at least say hi to you all! I’m still around and I’ll provide a bit of an explanation for my absence. The great news is, I’m not injured, nor sinking my money into an unfortunate cause. While I was gone, I went on a 6-day cruise, tried to gain more of a presence on social media (it’s crazy hard), and did A LOT of soul searching, and reconfigured my budget. We’ll get into the details about all of that but I’m sure you’re all wondering…have I maintained my budget? Have I done anything ridiculous? The answer is yes and no…but I’ll explain it all shortly. For now…grab a drink. If you’re a high-roller, grab your Stanley cup filled with your preferred beverage, and a snack and we’ll get started!

I’m skipping past January because I was still on vacation at the end and I don’t want to go back too far. Here are the topics we’ll be talking about for February:

- Income & Other Income Breakdown

- Debt Totals

- Payment Breakdown

- Net Worth

- Present Day – Money Moves Monday

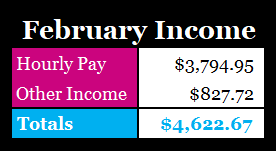

Income – February

I was still working with the adjusted federal tax withholdings in February and that is the reason for this amount being higher than normal. I have since adjusted the amount, I also got a nice raise in my first paycheck in March.

In February, I did receive a lot of deposits because I brought quite a bit of cash on the cruise and shared when my friends needed currency and couldn’t use a card. This was not a gift and my friends paid me back. With it being an even trade, I left these amounts off. I did receive a tax refund which reminds me. If you are a business owner like I am tally and report EVERYTHING! It’s been a huge helps and really puts things in perspective when I’m doing my taxes for the year. I am on target to make a bit more with my business for the year but it’s not likely that’ll make a huge difference.

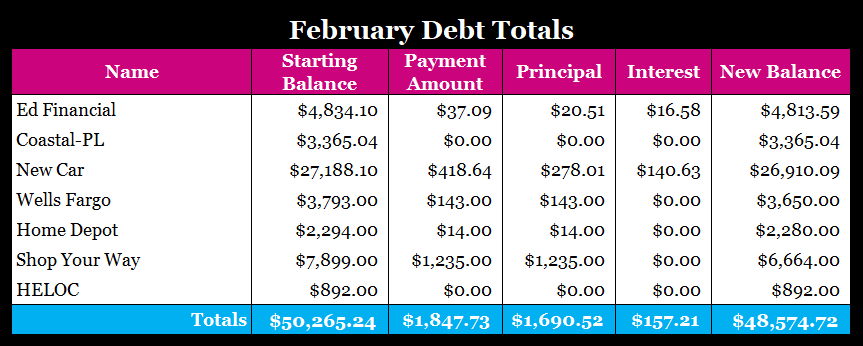

Debt Totals – February

I did have an increase in debt with my HELOC that I kind of hate, but it didn’t affect my overall debt picture. This is extras from the trip and a few other things I’ve been doing. This HELOC balance will more than likely go higher because I’m going to have my vents and air ducts cleaned, replace my garbage disposal, fix the ceiling fan in my guest bedroom, have my A/C serviced (I think it may have died), and have my doorbell fixed. This is the cost of homeownership. The only difference is my mortgage is significantly less expensive than rent for an apartment the size of my condo…so I can’t complain. Other than that, the numbers are going down!

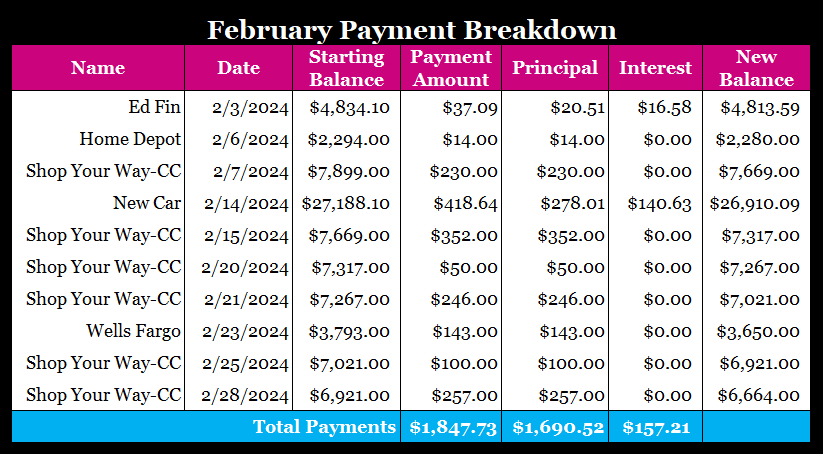

Payment Breakdown – February

I do put around $1,700-$1,900 towards debt every month, which is crazy when you look at it. What you’re seeing here is my norm.

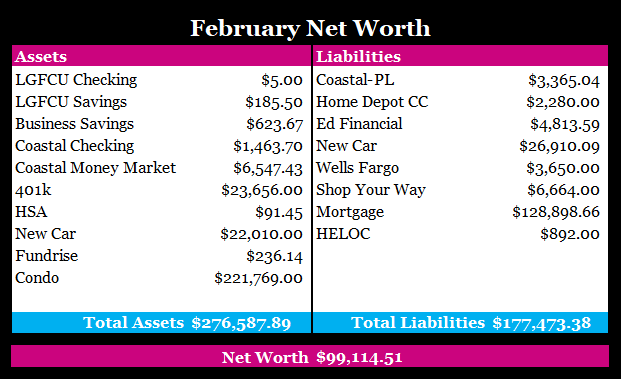

My Net Worth

I’m just below $100k as expected after the year I had. I do expect to rebound this year and do even better than I did last year. So we’ll see what’s up for the remainder of the year.

Present Day

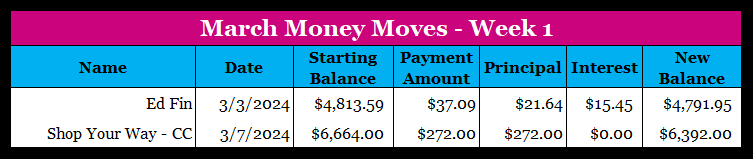

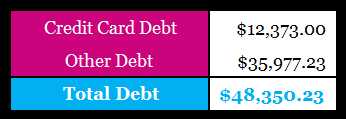

As of right this moment, the following is what I’ve paid in debt and what my current debt totals are broken down between credit card and other consumer debt.

Keep in mind with my credit cards, they’re all at 0% interest because of a promotion or because it’s a balance transfer that I’ll be paying down before they expire which is the biggest trick.

In other news, with my soul searching. I’ve been racking my brain trying to figure out what to do with myself and my debt situation. I’ve been reading Ramit Sethi’s I Will Teach You To Be Rich. Some of the concepts I can connect with and there has been a common theme that’s been popping up over the years…and that’s my need to begin contributing to my 401k again.

I began contributing in 2022 for some time and decided to stop it again because I just didn’t see the value and thought I was going to be out of debt this year. Yet…the universe has a tricky way of showing you who’s really in charge. So, I have reinitiated my 401k contribution up to the match at 5%.

Before I made that decision, I took a look at how that would impact my debt payoff and if I’d meet the expiration dates for my balance transfers and promotional balances. All is well so I fired up the contribution and it’ll take place in my paycheck next week. This will make a $100 difference in my paycheck. It also makes sense because I did receive a merit increase effective 3/6/2024.

I’ve been really feeling tethered to this debt lately. I don’t want my life to revolve around paying down debt, so I made a few other changes. After I payoff the following debts:

- Shop Your Way Credit Card

- Wells Fargo

- Coastal – PL

I will be pausing the aggressive debt payoff and will be putting all of my money towards building up my emergency fund for a few months for a breather. After that, I’ll go back to the aggressive payoff.

I’m not putting in dates to save myself the sanity of if it doesn’t happen but this is the plan for now.

Pro-Makeup Artist Tip

I’ve very recently started trying new things to help fight the oil on my nose. I’ve found a primer that seems to do the job with some extra help. I’ve been using a matte primer by Revlon, setting with a powder, and setting again with a liquid matte primer and that has literally done the trick. When you get frustrated with how your makeup wears, just like we get frustrated with debt payoff, keep trying new things. One of those things will be the ultimate remedy.

That’s all I have for today! I still owe my debt overview for 2023 and I’m hoping to get that out this week. Also! Don’t forget to like, comment, subscribe to see more content from me and to share my page with someone who you think may benefit from the makeup tips or financial advice.

Until Next Time!

Photo by Francesco Gallarotti on Unsplash

Leave a comment