So! The Earth has turned 7 more times and we are back on Monday! So let’s talk a little about my slightly monumental week. I paid a lot of stuff and I think it’s important that I share my progress. First and foremost…my weekend was good! I hung out with friends, met new friends, cleaned, cleaned while friends chatted me up, and well…prepared for the coming clients I have for makeup. All-in-all…it was a great weekend and I hope yours was equally as great or even better. 😊 So let’s get into my small wins this week! Grab some water, beer, wine, or tea and a snack to pair and we’ll get the show on the road!

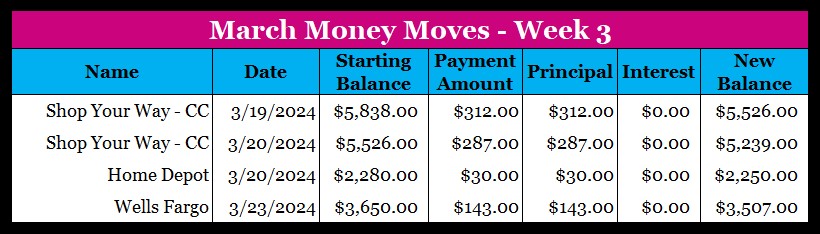

I came into some unexpected cash this week. First, I received cash back from Ibotta in a decent sum…the most I was expecting to receive up to this point. The second was a mileage reimbursement for driving to another location for a little over 3 weeks. Ibotta hasn’t hit my account yet, but the mileage did and I’ve gotten prepared to make some decent payments for the month. I’ll post next week for you to see what I received and how it all was broken down. For now, I’ve paid a total of $599 to my Shop Your Way Credit Card, $30 to Home Depot, and the usual $143 towards my Wells Fargo card for the new flooring I got for my home. By the way…the new floors…are GORGEOUS. They brighten up my space and I enjoy them. Anywho! I paid a whopping $772 towards debt this week!

With my bonus, mileage, Ibotta, and other cash I received for the month, I made a decent dent in my debt. I would love to say other months will be like this but bonus month is always the absolute best. My liability went down and I’m proud that things are going well. 😊 The number is crazy weird though…

I have gotten my info together for 2023. I keep saying that but before this week is up…it will be posted. So keep your eyes peeled for how my dumpster fire of a year went. I saw the numbers and yikes…I had…lockjaw…a broken foot that I had to go to PT for…mold in my car that broke me out in hives (I got a new car)…and the big one…my house flooded. Lucky me my garbage disposal is dead and I need to come up with a solution for that. The one thing that doesn’t make me as sad is my equity is more than likely much higher now than it was…I may consider getting my house appraised to get a higher limit for my HELOC…We’ll see though!

Pro-Makeup Artist Tip

I made a huge leap and am re-upping all of my makeup kit…with this revamp…I’ve made a HUGE decision to change my concealer type for sure and try to condense my products to the top part of my train case. This change will hopefully benefit my clients in the best way. This was a great idea because just like how debt is ever changing because of your situation sometimes you have to clear the slate and start over. This message here is to remind you to get rid of that old lipstick, get rid of those old eyeshadow palettes, clean your brushes (for the love of God, CLEAN YOUR BRUSHES!) and start fresh with a fresh new face of makeup because some how…your results just might change.

That’s all I have for today! Don’t forget to like, comment, subscribe to see more content from me and to share my page with someone who you think may benefit from the makeup/skin care tips or financial advice.

Until Next Time!

Photo by Giorgio Trovato on Unsplash

Leave a comment