Hi and hello! I finally sat still and got all the numbers for 2023 put together. Please know…I audibly gasped at the numbers and you’ll find out why in just a moment. This is about to be extremely interesting and slightly embarrassing. I had A LOT of unexpected things happen throughout 2023, but everyone’s journey to pay off debt is going to look different. I’m not 100% anti-debt and I still use debt to meet my own financial goals if it makes sense. I just want to lower the price tag a bit to refocus what I have been spending all my money on from month-to-month and I know I’ll eventually get there. 😊 Let’s go ahead and grab a frosty beverage and a snack and we’ll get this show on the road!

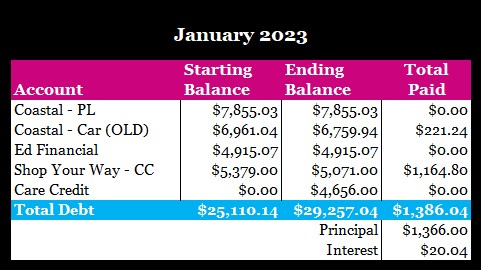

In January, I focused on my Shop Your Way credit card. This month I had previously planned on doing a balance transfer for some business expenses from 2022 and ended up paying $1,1604.80 total towards the card that month. The rest of the balance went to my car loan. The Care Credit balance went up for my treatment of having lockjaw…yay me… Lockjaw was the beginning of the many things that occurred that were just hard to grasp this year.

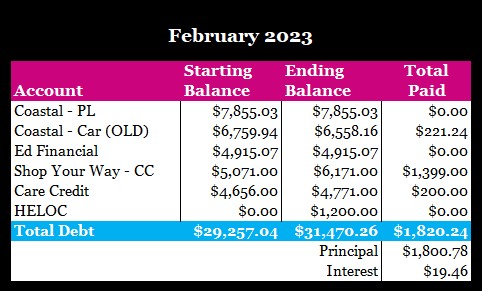

February is another month I focused on my Shop Your Way credit card. This was the last month I did the balance transfer for business expenses and I anticipated the balance going up. I paid a total of $1,399 towards this credit card. I paid Care Credit $200 for treatment for lockjaw. I also had regular visits that were $129 every time I went. This is the time I heavily considered becoming a sugar baby. My HELOC balance went up for the trip I took in February to DR and I don’t regret it for one moment. We all need a moment sometimes to just regroup. Just don’t let anything that you do set you back so far that you’re starting over again.

March I got really aggressive. The primary focus was on the Shop Your Way credit card and went for Care Credit and My HELOC. I also kind of…broke my foot at the beginning of the month and couldn’t leave the house. March is also the time I began to be more consistent about tracking these little details that I so love sharing with you all. Other than that, I received a bonus that was gobbled up by federal taxes (kiss my a** Uncle Same) as well as my tax refund thanks to being a home and business owner. When I get extra money, I put some to savings and a healthy chunk towards debt to get the needle moving a bit.

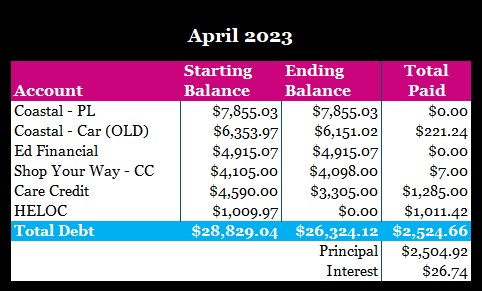

April, I decided to payoff my HELOC balance that had acquired due to my trip to DR. I then began paying down Care Credit because the promotional 0% APR was going to be expiring shortly and I wanted to get ahead of it. I slowed down with paying down my Shop Your Way credit card and reverted to only paying the minimum. I didn’t realize I paid as much as I did this month so again…some of these numbers are really shocking. Keep in mind…I was stuck in the house because my foot was still in the boot during this entire month.

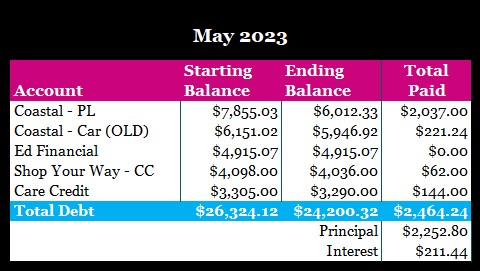

I got the promotional balance paid off for my Care Credit card and I decided to make another shift in May. I started paying off my personal loan because the payment was coming due in August and honestly…the monthly payment of $260.88 just didn’t seem reasonable to fit into my budget no matter how I readjusted it. Since this was going to be due shortly and was accruing interest, I decided to work on it for a short amount of time so I could be all caught up with paying the minimum for quite some time (clear over a year to be exact). I was still stuck in the house and still making chunky payments towards debt which I’m quite proud of for now…I tell ya…I’d break my foot again if it meant that I could spend less on things. Minus the pain, foot accessory, and all that comes with having a broke foot…that was very unkind and I still can’t wear high heels.

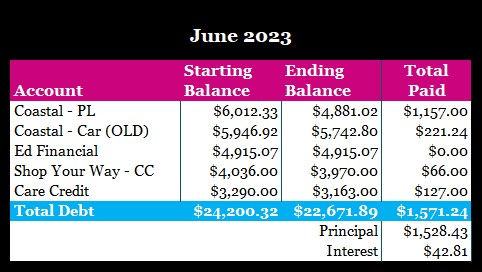

June I still worked on that personal loan and everything else was being paid at the minimum. I did go to physical therapy this month because of my broken foot and paid for it with Care Credit. Turns out that my ankle wasn’t not flexing properly. The doc said to ween, I tried it and I just couldn’t make it work comfortably. It was a very necessary expense that unfortunately caused a big ordeal with the interest that was finally resolved in December.

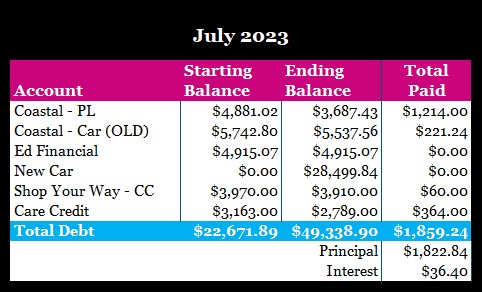

Ah…July…another disaster struck. Thanks to breaking out in hives, I was able to realize my car, which was a 2014 Nissan Rogue, had clogged sunroof drains and resulted in a mold infestation in my car. *Dry heav2* The hives warranted a trip to the ER…and I still had about $1,500 of work to put into my car beyond the mold, things were falling apart, and I kept hearing about transmission issues that ultimately happen with Nissans. I made a huge decision to get my sunroof drains fixed, I detailed the car, and drove a rental for a week because it needed to dry out, and sell Bennie (that was her name). If it weren’t for this, I’d be debt free this year, even with the rest of the crazy you’ll see this year. Great news was I found a new car this month! A 2020 Mazda CX-5 that had less than $20k miles. Since it’s property, it comes with a value and I’m not doing too bad. I also plan on driving this car until the wheels fall off. Besides the cost of getting a new vehicle…I’ve honestly got no regrets because I myself would never purchase a new car in cash. In other debt news because I’m rambling at this point…this was my last big payment I’ve made to my personal loan.

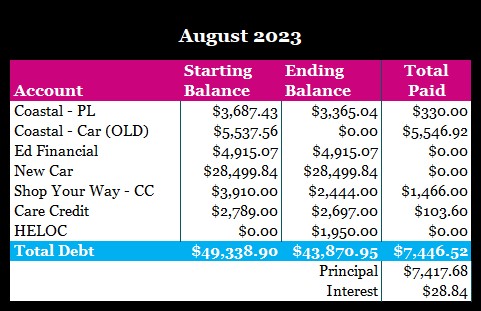

August I slowed way down on paying my personal loan and then I began to hit my Shop Your Way credit card hard. Thing about it is, my personal loan was accruing interest daily and still is. It is a closed end loan unlike a credit card and once that balance is gone…it’s gone and I couldn’t be more excited. Goodbye $260.88 monthly payment! Until then…the next due date is in February of 2025 . When I go to make the payment in the future which should be this year, you’ll see a very large portion of the first payment go towards interest. In other great news, I sold my Nissan on August 1st (I’ll miss you Bennie!) and the loan was paid off on August second.

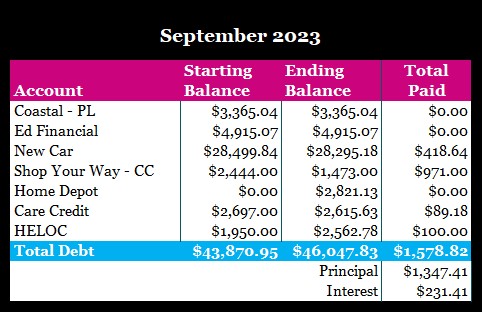

September was the beginning of a few things. It was the first month with the new car payment and interest resumed on student loans. With that being the case, I applied to see if I could get a lower monthly payment. My original monthly payment was going to be $74.17 and they had mercy on my and dropped my payments to $37.09! This is why it doesn’t hurt to try, even if you think your income is higher than what is allowed. Any who! I was able to put almost $1k towards my Shop Your Way card which was decent, I was getting used to my new everything this month.

September is also the month I had the very bad paint job done and over bought paint that was surprisingly handy at a later date. I also had new carpet installed this month in my bedrooms. It was the best purchase ever. I still made progress but I did have extra debt thanks to my home improvements and my home failures. For me…that’s not a huge deal though because it is something that will help the equity for my home.

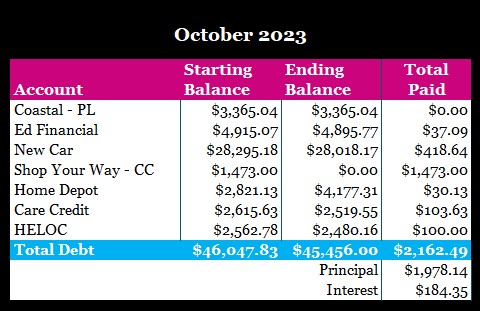

October, I got paid 3 times this month and I made great strides with debt. I paid off my Shop Your Way Credit Card which was a HUGE deal! I was working on getting over September and I made my first student loan payment since the start of the pandemic. But don’t get too excited because thanks to the toilet valve not realizing the tank was full in my guest bathroom, my condo flooded on October 12th. Such good times. They tore out a ton of carpet and about 2ft of drywall in the bathroom and utility closest. I now needed that extra paint I bought. Things kind of took a nose dive from there. Insurance paid for the water repairs…but I’m a little scared to see my new home insurance bill this year. I did get a new refrigerator that I’m having serviced this week because it makes weird rattling noises. I’m super thankful for my first year’s warranty for this thing and I may do one of two things…add the fridge to my home warranty for 2024 or get their extended warranty. We’ll see what makes sense.

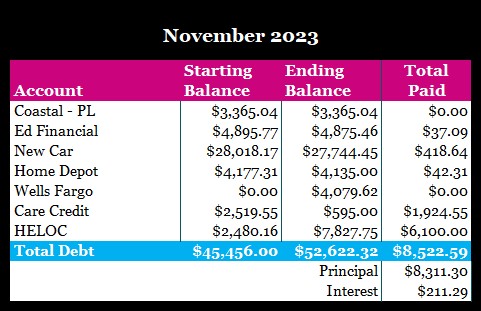

November had to be the most tumultuous month. This is the month I learned how you should interact with the insurance company when it comes to flooring and materials. The work started on my home on November 10th. The living room and kitchen were totally out of commission until the Monday before Thanksgiving so I was going out to eat daily. Then, I finally had my whole house back! It looks great in here really. I also caught COVID a second time while the crew was here. *Sighing deeply*

I made a decision to pay the contactor from my HELOC and just paid it back in increments through the rest of the month. The insurance company sent me checks to pay for labor and materials. It just didn’t cover ALL of the materials because they’re super shady. This caused me to end up with higher debt because my floors were very expensive and I had to open the Wells Fargo credit card to pay for them. $4,100…ouch…but we’re getting it paid down. I was super bummed about being back over the $50k mark in debt that I worked so hard to get below. Not all the balance for the HELOC was for the contractor. There was a balance left over from September and some of the other things that occurred while I was having my home worked on.

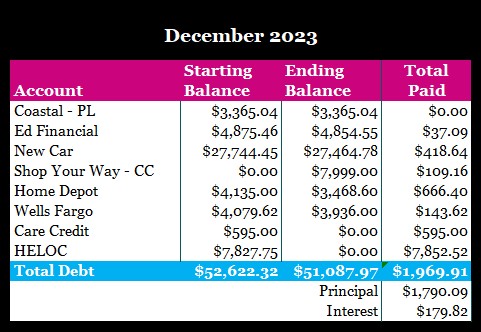

In December, I paid off my Care Credit card. YAY!!!!! No more lockjaw bill!!!!!!!! I also started working back on my Home Depot credit card because the new fridge I bought needed to be paid off by April 2024 because I had a 6-month promotional interest at 0% APR. Come the end of the month, I made the decision to transfer the balance from my HELOC to the Shop Your Way credit card because it made the most sense at the time. I didn’t count the balance transfer as a payment. This is the debt I’ve been focused on since the start of the new year.

Recap

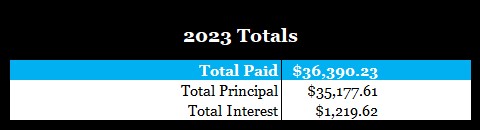

I paid a total of $36,390.23 of that amount, $35,177.61 went to principal, and $1,219.62 went to interest. Of the total I paid, 3.4% went towards interest which was overall great but more than likely will trend higher this year because of my car payment. Some of the interest was refunded, like in the instance with Care Credit. I’m not sure what 2024 is going to hold but I do hope I can get just a little close to what I’ve done for 2023. Mostly with hopes that I have a significantly lower number of emergencies than I did in 2023. LOL!

Speaking of paying down credit cards…I learned that credit card companies call people like me who don’t pay interest…deadbeats…LOL!!! I’ll be a deadbeat all day long in this case.

Pro-Makeup Artist/Licensed Esthetician Tip:

This is your friendly reminder to brush your teeth and cleanse your face twice a day and don’t forget the SPF! Just like the year comes and goes, you will wake up one day and wonder what happened to the phenomenal skin you used to have like I did last week. Sure…I’m not 26 anymore but! If we focus on our skin now, it will be good to us in the future. 😊

That’s all I have for today! Don’t forget to like, comment, subscribe to see more content from me and to share my page with someone who you think may benefit from the makeup/skin care tips or financial advice.

Until Next Time!

Photo by engin akyurt on Unsplash

Leave a comment