Hi! Long time no type. 😊 I went on another unintended hiatus. I want to say I’m going to stop doing that but life has a way of kicking you in the shins. I had some wins, losses, and the things that happen in between. I now have a roommate. I tried helping her get acquainted and get things situated before her move because I know her. The move was nothing shy of traumatic. The movers were the biggest pile of trash I had ever worked with. They were 4.5 hours late and moved my friend’s stuff 18 hours straight. In fact…I yelled at them after sleeping 3 hours because they were insisting on charging my friend $600 more than the price charged all because they didn’t have the proper equipment. The equipment consisted of a pickup truck and trailer for a two bedroom and she had already informed them that it was a big move. Sooo yeah…fun times. I have something else that’ll be visible in in June’s Money Moves Month End and it’s pretty big. I’ll give some details around it but we’ll see how I feel when the time comes. Next! I visited my family in KCMO. I have a new chunky nephew that I got to meet and he’s the cutest smiliest (I don’t care if that isn’t a word) little dude I ever saw! My other nephews are great, mom is struggling. I’m so bossy so I fussed her out and told her I didn’t want lose both of my parents before I turned 40 so she needs to take care of herself. Grandma’s doing great but her house…yikes…it’s 114 and it’s definitely showing its age. I got to spend time with my brother and his mom and my sister as well who did celebrate her 40th birthday. Overall…it was a great visit.

When I returned, I started back in on my health again…I have not been feeling great since May, I had an MRI and the results I was given were way wrong. I visited two specialists…both were like…nope…nothing is wrong and unfortunately there was nothing else they could do for me. So, I went down an old path I was used to, thanks to an NP I worked with in March…and I visited a Rheumatologist. I may have mentioned this before but I was diagnosed with Juvenile Rheumatoid Arthritis when I was 11. I have a significant amount of joint damage all over my body sadly. I was under the assumption that I was in remission because I no longer test positive for the Rheumatoid Factor and I haven’t had any “new” flares. I also had a Rheumatologist in 2014…yes…sigh…10 years ago who said I had “inflammatory arthritis” and never said exactly what was going on. Her practice closed soooo that was a wrap. This new Rheumatologist is very nice, very thorough, and seems to care about me getting back on track because I’m definitely NOT in remission. In fact…it’s looking like instead of RA, I have Psoriatic Arthritis based on my symptoms. I’ve been taking a few drugs to try to get things under control and I am not having a good time. The fatigue is unreal, the pain is ridiculous. I’m spending each day trying to get from one moment to the next. It’s been very challenging. So that’s a recap of my life for the almost past 2 months. We can now move on to the areas you all came here for. Thank you so much for reading this far. Along with my life changes, I’ve got some new numbers to show you all to share how everything kind of impacted my debt. So grab something to drink and a late spring friendly snack and we’ll get started!

You all know the routine…I hope. These are the topics of conversation:

- Income & Other Income Breakdown

- Debt Totals

- Payment Breakdown

- Net Worth

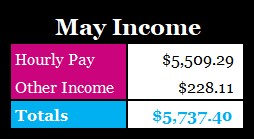

Income – May

May was a 3 pay period month so the numbers are inflated but it helped out in big ways.

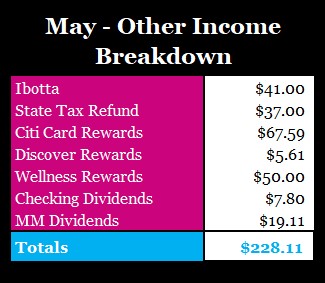

What I can always appreciate is the extra bit of income that comes with the little things I do. It also helps me make it to the next level.

Debt Totals – February

I had another increase in my HELOC because I had some things done. Number one…my AC was for sure dead. I needed to have it repaired and it cost roughly $800 + $85 for using my home warranty…bastards. I paid for my trip to KCMO. That was a lot of money. I paid for furniture assembly and I’m sure other things that I can’t remember because April was a complete blur. I also opened a new credit card to again help with paying for things around the house. I bought a few things. The goal is to pay this off before the summer ends. My Shop Your Way credit card…chef’s kiss! I started with a balance of almost $8k and we’re almost done!

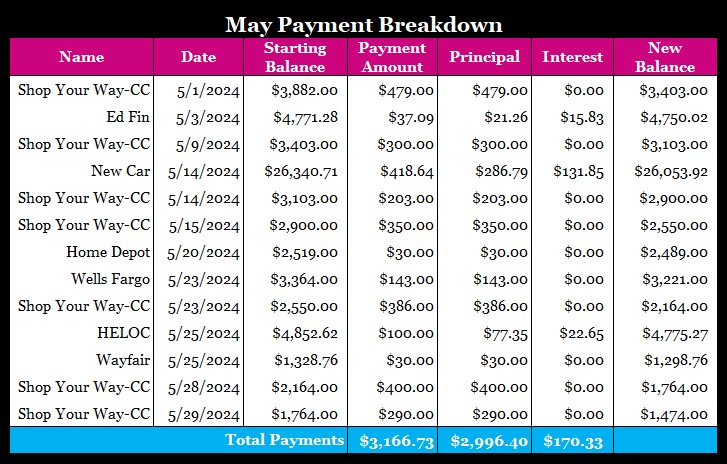

Payment Breakdown – February

This is a very long payment breakdown and A LOT happened. I had a lot of money left over from my April Paychecks and I ended up throwing it towards debt in May. I wanted to keep up the momentum to get rid of this credit card and I’m on my way. 😊

My Net Worth

I’m back over $100k! I was in April as well so hopefully this will continue to go up.

I’m still around…still trying to get things under control slowly and live life while things are happening.

Pro-Makeup Artist Tip

Let’s talk latex. This past weekend, I did a trial for a bride and her mom. When the bride reached out to me to give me a recap of how the makeup wore and share any changes we needed to make she mentioned one big thing happening to her mom. Her mom was experiencing some burning and some itching. My first thought was I was being super vigorous with the razor and she was having a typical response to it. I shared that thought but also asked where the problem spot was…boy was my thought wrong. Turns out the trouble spot was the outer corner of her eye…where I had attached lashes. I always ask for any allergies ahead of time but there are times when parts of us are sensitive to certain things. Latex is a very common allergy and there are lots of products on the market that exclude it. If anything itches, burns, turns red, or you end up with a hive It’s a reaction and should be handled just like allergies.

Don’t forget to like, comment, subscribe to see more content from me and to share my page with someone who you think may benefit from the makeup tips or financial advice.

Until Next Time!

Photo by Jungwoo Hong on Unsplash

Leave a comment