Alright! The weekend is over and today is my first day driving to work since March 2nd and I’m so happy that I don’t have to pay Lyft for today’s trip. I’m not due in until 8:30 AM but I’ve got to get up and going relatively quickly because it takes a moment. I also have to transfer out of my driving boot back into my walking boot because I don’t have a shoe that can support nor fit my puffy foot that’s still reasonable fashionable. I’m not ready to start wearing orthopedic shoes yet. I just don’t know how to make that work. LOL! Anyhow, let’s chat a little about today’s Money Moves! Grab yourself something to drink and a nice snack that you’ll be easily able to walk off because summer is here…and we’ll get started!

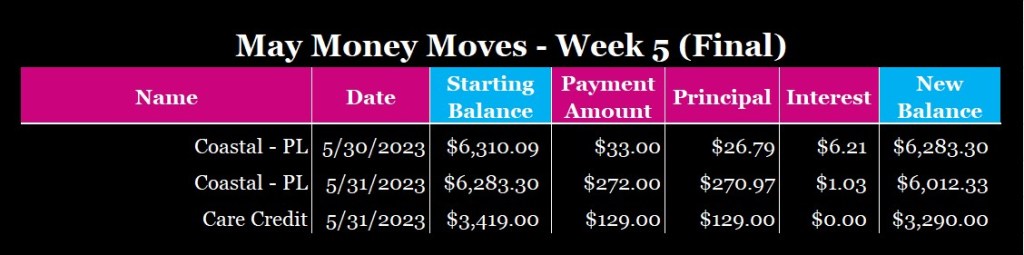

For my progress for this week, it was all about my personal loan and make a payment to my Care Credit card to clear the charge I made when seeing the dentist earlier in May:

I’m realizing these figures are hard to see. Zoom in on your device to see the numbers clearly. I’ll make an adjustment to make it more legible.

And now for the moment you’ve all been waiting for:

Getting below $25k happened almost as fast as getting below $24k. Next time you all will see be that goal has been achieved! Based on how things have gone, I make roughly an extra $1k in payments every month.

Since these are short posts, I have an update I’d like to share. I meant to share this when I made my last update for my paycheck but that’s what consistent posts are for. 😊 My income will go down by $6.57 because I opted-in to emergency and critical illness insurance. Had I had this insurance last year, it may have helped with having TMJ or breaking my foot. Since it’s such a low amount, I didn’t see the reason why to not go for it. Open enrollment for my job is the first two working weeks of May so the benefits plans can be solidified by June.

Update #2 is, I finally came to a decision about my car. By time June of 2024 rolls around, I’ll have just over $3,400 remaining on the loan. While it seemed reasonable to keep paying monthly until September of 2025, it’s going to be a lot quicker and a lot less painful to pay for it now. But! With it being my very last loan payoff, I’m upping my sinking funds to $200 per paycheck. Once I’m all done, I’ll contribute $50 per paycheck to Fundrise and I’ll work on saving to fully fund my emergency fund and HSA contributions for the year.

I really wanted to wait it out but it felt more reasonable to make the decision now. I also have big news to share for tomorrow’s post!

Pro-Makeup Artist Tip:

So! While we’re telling debt who’s boss this summer, let’s tell our foundation who’s boss especially when it comes to sweat and your foundation. For those of you who use a liquid foundation during the summer, there is a product that helps water proof your face to help keep you looking flawless. I especially love it for brides to keep their tears from ruining their makeup. It’s by Makeup Forever and is called Aqua Seal. One small vial lasts me through the expiration. Do keep in mind, every summer the product sells out so it’s not a huge secret but it’s super helpful to have in your arsenal. The next product that I can recommend but I haven’t had the opportunity to try yet is the One Size ‘Til Dawn Setting Spray which has a promise of holding your look in place for up to 16-hours! I cannot wait to give this product a chance! Neither are miracle cures. Wiping with a makeup cloth or anything oily encountering your skin could potentially affect the wear. I like to do a test to see how things go on my own.

That’s all I have for today! Don’t forget to like, comment, subscribe to see more content from me and to share my page with someone who you think may benefit from the makeup tips or financial advice.

Welcome new subscribers! As soon as I hit 100 subscribers, I’ll host a giveaway. Knowing how practical I am, it’s highly likely it’ll be cash a cash giveaway.

Until Next Time!

Photo by Precondo CA on Unsplash

Leave a comment