It’s been an official fiscal week for me for the month of June and it’s time to share my progress! It’s nice and late the night before this post arrives and while I have been aspiring to say I’ve done nothing this weekend, that was a lie. I had the opportunity to drive a bit more. I started PT and my foot is working so much better but it’s still a struggle. I’m even considered purchasing…*gulp*…Crocs. My stylish index is plummeting like the stock market a few weeks ago during the negotiations for the debt ceiling. The reason behind this is because I still can’t wear regular shoes AND my foot is continuing to have issues with swelling and pain. None of my shoes except my bedroom slippers and flip flops are supportive and wide enough to tote around this chubby foot of mine. Friday 6/10 in the morning, was the first time in months that my foot looked normal! But throw a shower in there and you have a foot that looks like a puffer fish. Any who! We have some progress to discuss this Money Moves Monday that I’d like to take you on a journey for! So before we officially dive in to the content, let’s get that customary snack and a something to drink and we’ll get started!

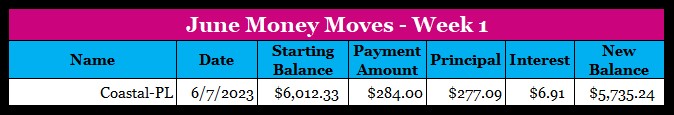

I literally, I mean LITERALLY did nothing this week but put a little towards my personal loan. The great news is, I had more to put towards it than I originally forecasted thanks to some cash back I received from Upside. I did update how it looks because I feel like the white text was getting lost since the image is a little small. I hope this is more visible:

Let’s take a look at my overall debt numbers because…

I’m below $24k!!!!!!! Well…technically. Thanks to needing physical therapy, I am spending $80 per visit and I’m going 3x a week for these first two weeks. The goal is to work hard and graduate ASAP. Does this make me angry? Very much so. I don’t want to drain my HSA nor use my Emergency Fund but my post about Emergency Funds tells me to suck it up and pay it. I have money in my HSA so it’s likely that I’ll use that to make it happen first but once there’s nothing left…I’ll have to start to dip into my Emergency Fund. I mentioned before in my post about Emergency Funds that even on a debt free journey we all encountered an emergency. This is one of many issues I’ve encountered and I’ll treat it as such to move on to the next level. Regardless of what’s going on, my experience with my debt payoff has been immeasurable. I’ve had more positive things happen than negative and for that, I’m so grateful.

This week is a pay week so keep an eye out for when my budget is closed out tomorrow and when my new budget begins on Wednesday!

Pro-Makeup Artist/Licensed Esthetician Tip:

We’re in the midst of very unexpected changes personally and collectively and one thing I never want anyone to not expect is how their lips should feel as they continue to learn ways to better take of their skin. Human bodies need so much maintenance and lips are one extremity that tell a lot about a person. One thing I see regularly is dryness, flaking, and sores from both. If you experience lips that flake, DO NOT PICK THEM, because you will cause your skin to begin to bleed. Instead, cleanse your face to rid your skin of any bacteria and grab a clean wash cloth. Soak that wash cloth in very warm water and rest it on your lips. This will give your lips the feeling of being in a sauna. Once your lips are no longer flaking or dry, proceed to exfoliating them. I like to use a clean dry wash cloth to wipe the dry skin off but you may also use the lip scrub of your choice. Follow this up with a decent lip balm and continue to apply as needed. This will keep your lips pouty and soft.

I suffer from mild eczema during winter on my lips. It’s uncomfortable and very textured, so I follow these steps and before applying my moisturizer, I rub in some hydrocortisone to aid in healing the skin and typically all is well.

That’s all I have for today! Don’t forget to like, comment, subscribe to see more content from me and to share my page with someone who you think may benefit from the makeup tips or financial advice.

Welcome new subscribers! As soon as I hit 100 subscribers, I’ll host a giveaway. Knowing how practical I am, it’s highly likely it’ll be cash.

Until Next Time!

Photo by Colin Watts on Unsplash

Leave a comment