This seemed to work out pretty well last time so I figured I’d present this information the same as I did last pay period. Of course, I’m late posting again. It’s been slightly crazy because sleep isn’t something that comes easily for me. I go to sleep and am losing close to an hour of sleep every night with restlessness or I’m just…awake. I’m sure there are a few things that I could change for now before I go running to my doctor trying to make sense of things and that’s what I plan to do for now. Now it’s time to chat about how I closed out my budget for my first paycheck in June and discuss what I’ll be paying for my second paycheck in June and how that will look regarding debt payoff. It’s time to grab a snack, I recommend a popsicle or even ice cream because summer is in full swing and feel free to skip your drink if desired and we’re going to see how things went and will go!

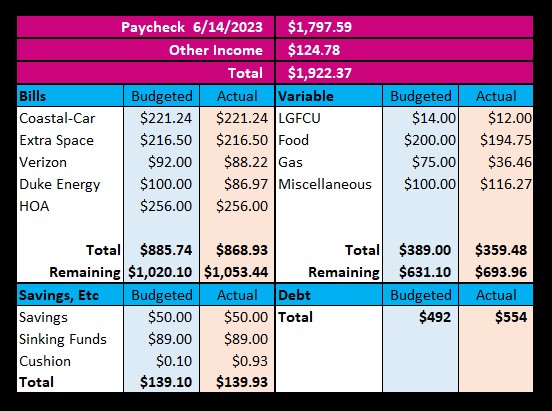

I’m so excited with how this pay period went that I could just spit! Not really…that’s disgusting:

My car, storage unit, and HOA stay consistent. Between Duke Energy (electricity) and Verizon, $16.81 was left over in my bills category and really helped with how much I put towards debt. As for my variable bills, I paid $2 shy for LGFCU, $5.25 shy for food, $38.54 shy for gas, and $16.27 in excess for the miscellaneous category. I keep the savings category pretty straight forward and for now it’s always $50 to savings, $89 to sinking funds, and any change that is remaining gets tossed into my cushion that is now a total of $211.44 because I don’t like to draw my account down to far and it’s best to put the change somewhere. With all of the activity I had, I made a whooping extra payment of $62 towards debt! Yay me!!!

During this pay period, I did take $400 from my LGFCU account to put towards my balance for physical therapy and I can tell you…I was a little upset because I had to go back to their branch twice because they didn’t read my first slip correctly and I only received $40. I also don’t understand this form of banking because I also didn’t realize I had to tell them to give me hundreds only. Instead, I have a fat stack with a bunch of $20’s, $10’s, and $5’s and I deposited the funds at a machine for my primary bank to do the transfer to my HSA (Health Savings Account).

To add to this bit of a disaster, I had to postpone my Crocs purchase because I didn’t have enough time and I ended up having to pay for more gas because of the back and forth. It was a lot to do on my day off.

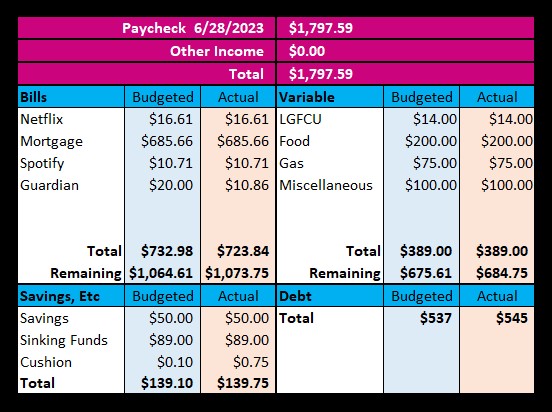

How are things looking for this pay period? I’m glad you asked!

Not too shabby right? Everything is pretty fixed as it will occur. With today being the last day of the month, I will be tallying all of the interest I have accrued on my accounts so the other income field will look slightly different from the $0 balance it’s showing.

I know I took that $400 out to take care of physical therapy but I’ll be slowly building that balance back up over time. I’m just glad it was there for me when I needed it and I didn’t have to touch my main savings…yet.

Pro-Makeup Artist Tip

What I love about being a licensed esthetician and makeup artist is a lot of people begin to talk about the troubles they experience with both their skin and finding the right solutions for makeup. I also have a friend that owns a cosmetics company and learned that some are weary of purchasing products that are specifically for eyes, such as eye shadows, because it simply intimidates them. Just like budgeting, practice make perfect. When I first started doing my own makeup, I was 22 and started with one lilac eyeshadow pot and a retractable eyeliner in a charcoal. It grew into being a lot more creative and freedom to experiment. Fear of the unknown can cause us to avoid doing a lot of things that could be a wonderful thing for our lives.

That’s all I have for today! Don’t forget to like, comment, subscribe to see more content from me and to share my page with someone who you think may benefit from the makeup tips or financial advice.

Welcome new subscribers! As soon as I hit 100 subscribers, I’ll host a giveaway. Knowing how practical I am, it’s highly likely it’ll be cash.

Until Next Time!

Photo by Dose Media on Unsplash

Leave a reply to Brushes & Budgets Cancel reply