The name for this post us super long…I hope everyone had a great weekend! Have I got a treat for you! I totally skipped announcing my current budget details last week so I had to combine it with my Money Moves Monday Post. This is going to be a nice long post so you may need a heavy snack to entertain you while we discuss my debt totals and budget for the current pay period we’re in. I’m keeping my intro short because I have another announcement to make but let’s go ahead and get started!!!

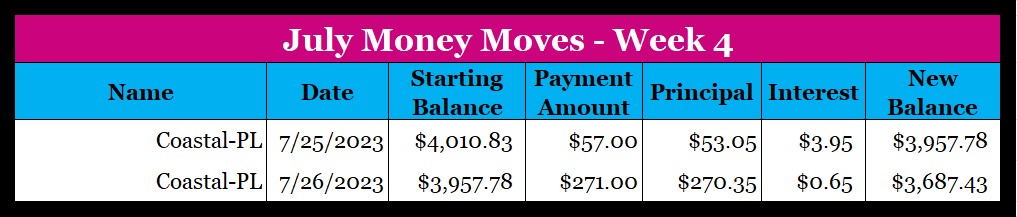

Before we get into the meat of today’s post, let’s chat a little about the payments I made last week:

I made two whole payments but as you may see, I had an extra $57 left over from my budget to apply to debt. That was exciting for me because I always anticipate having at least $10 left over from my budget. The beauty of this all is it helps me make extra payments which means my debt will be reduced just a little faster.

As of last week, this is how much I have in credit card and other debt:

I’m officially below $20k! It will be EXTREMELY short lived which brings me to my announcement.

As of today, I’ll be adding $28,500 to my current debt totals because I did find a car. It’s a 2020 Mazda CX-5 Grand Touring with 19,350 miles on it. I carefully considered what I needed/wanted in a car and this one is ideal for my life. I signed paperwork on Friday and will be picking the car up today along with selling my Nissan Rogue. While I’m excited to have a new car, I’m not excited about the extra debt I’m taking on. This payment will be close to $200 more than my monthly payment for my Rogue. I also have some really concise tools I use to calculate debt payoff. I won’t find out how much my exact interest rate and monthly payment will be until today but based on my calculations for a $417 monthly payment and a 6.04% interest rate (it’s likely both will be lower), I’ll pay it off January 2026 unless I decide to pull funds from my savings which is a huge possibility. My last debt before this will be my student loan that will be paid off in July of 2024. Once that debt is paid off, I will begin saving $50 to my Emergency Fund like usual and $100 to my sinking funds. Things will be really interesting. I’ll be back to having $20k of debt roughly around October 2024. If you don’t know by now, I’m a numbers nerd. I also had some adjustments made because the payment was $458.17 (over my anticipated budget of $450) because the sales person added a $3084 extended warranty without making sure I was okay with it, as well as offering to give me new plates which was also very strange considering, I have plates and was going to have to pay an extra $33 for new plates I didn’t need. Nor did she offer to make the updates, so I went in to get that resolved on Saturday. It was a whole thing. Moral of the story…don’t let dealership sales people bully you. If you’ve done your research for the vehicle and it’s a good reliable car with low or decent mileage, you more than likely will NEVER use the extended warranty. And they cost out the a** and that will ultimately impact your bottom line. I’m so glad I had the weekend to think things through before pulling the trigger!

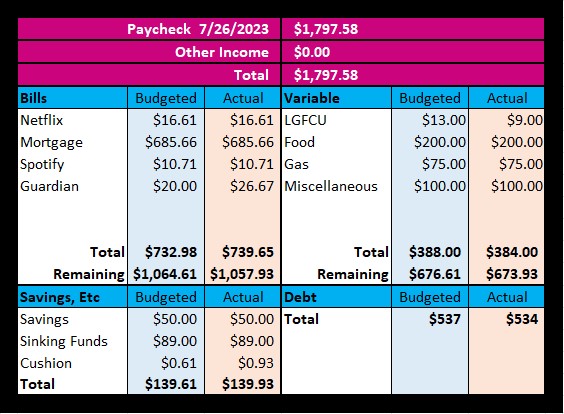

On to my budget close out and July Paycheck 2! As for my first July Paycheck, I’ve got my duckies all lined up and this is how things finished:

When I made my last car payment…I had no idea it would be my last car payment! Depending on when the payoff check arrives, I could have to make one more payment but I will get an extra $1300+ over my payoff amount for my car. I was informed that someone is interested in buying my car but they’d better move quickly because I can’t drive two cars at once. Other than that, everything was as expected with the exception of Duke Energy. I anticipated paying $100 and paid $97.37 just last week. For my variable spending, I budgeted sending $14 to my LGFCU account but sent $12 thanks to a few extra charges posting to my debit card (there’s a method to my madness). For my food budget, I budgeted $200 but spent $201.73, better than my last paycheck close out, but I try my best to keep things under control. That didn’t matter in this instance because I budgeted $75 for my gas but only spent $38.26 which is a nice amount that I didn’t spend. Finally for my miscellaneous spending, I budgeted $100 but spent $81.59. Overall for variable, I anticipated spending $389, but spent $333.58. For Savings, I budgeted $50 for savings, and actually spent $50 for this category. Sinking funds and the cushion were also consistent. I have thought a while about putting LGFCU in Savings but it really does serve a purpose in the variable category. As for good old debt, I budgeted paying $492 for debt but ended up spending a whopping $587! This was partially because of my other income plus my budget excess. For my other income, I received $109 instead of the $108.25 normally budgeted, $12.25 for Citi Card Rewards, and $20.19 for a cashing out Ibotta. I typically have an opportunity to cash out my Ibotta points every 2 months. You have to hit a $20 threshold before they’ll allow you to send money to your bank account. I highly recommend it! I may grocery shop twice during a pay period but it eventually adds up. Next is Upside but they recently changed the rules to a minimum of $10 for cashing out for gas.

For this particular pay period this is the plan that I’ve drafted:

Netflix, my Mortgage, and Spotify are all the same. As for Guardian, I paid A LOT less, last month but this month, they got me back. Sigh…but it’s cool! I have made up for it with some rewards I’ve redeemed (not listed). I also adjusted my LGFCU actual to $9 because I sent everything I needed with my last paycheck. The big money drains food, gas, & miscellaneous are all the same as well as my Savings with the very small $.32 cushion I keep in my checking account. Yes, debt is lower but I will be paying more than the budgeted amount depending on how things go with the interest I’ll be paid for the month. 😊

Pro-Makeup Artist/Licensed Esthetician Tip

This is nice and quick because I gave a lot of detail in the post. If your skill is not healed from manipulation, allergies, injury, etc., it’s okay to let it rest. Try your best to not apply anything more than your usual skin care. This will be harder for those of who have acne-prone skin, but give it some time and be patient with yourself.

That’s all I have for today! Don’t forget to like, comment, subscribe to see more content from me and to share my page with someone who you think may benefit from the makeup tips or financial advice.

Welcome new subscribers! As soon as I hit 100 subscribers, I’ll host a giveaway.

Until Next Time!

Photo by Elena Koycheva on Unsplash

Leave a comment