So! I’m oh so lucky because official debt freedom will be postponed by a little over a year, hence, the header. My ice cream fell out of the cone and then onto a surface that’s not edible. I get to rant just a little longer on my blog and that actually excites me in a sense. I’m not so excited about extending my timeline and extending my savings goals. But…new car is oh so sexy. It drives like a dream! That part…I don’t regret…along with my old car being full of mold…that I’m allergic too. Anywho! Lets go ahead and get this party started by grabbing our snacks and something to drink! The summer is coming to an end and I just face-planted at the finish line so let’s be sure to eat our feelings temporarily.

Like always, I’ll be sharing the following the Money Moves Month-End for July:

- Income

- Debt Totals

- Payment Breakdown

- Net Worth

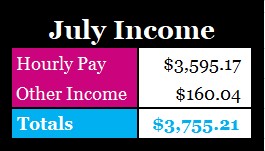

Income – July

My income varied a little more this month because I cashed in some rewards through Discover, Citi Card, & Ibotta. I also received pretty good cash in dividends for my savings and checking accounts.

Debt Totals – July

When I shared last months Money Moves Month End, I had no idea what waited for me with the mold. So here we are with new official numbers for the month of July. My first payment isn’t due until 9/14/2023 so I will be using my last car loan payment to drop my debt a little. As the months go by, you’ll see me chip away at the debt and try my best to bring these numbers back down. I’ve done it before, I’ll do it again. 😊

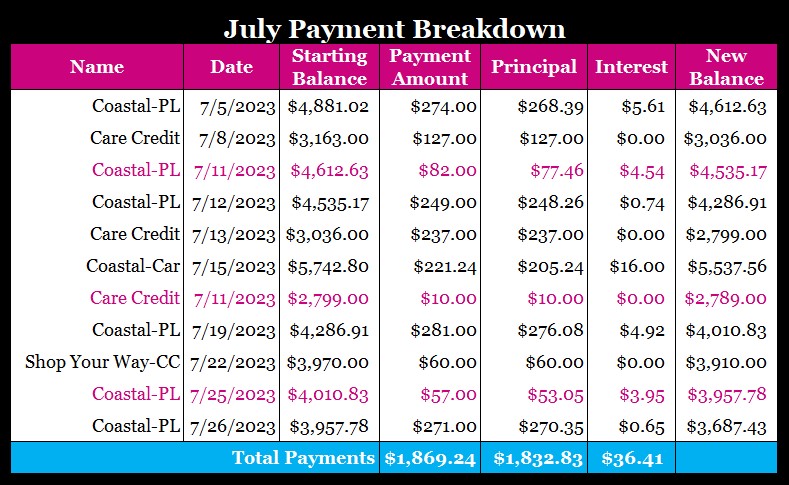

Payment Breakdown – July

These payment breakdowns really have helped me realize what I’m paying beyond the 3M posts. I hope this helps paint a picture for you all as well! They’re definitely helpful but so is having all the information in one place. The numbers still excite me no matter where I am financially.

My Net Worth

This is what my net worth looks like for the month of July:

I managed to be above $100k again this month, even with all the crazy of getting a whole new car! I’m very excited about that and it makes me want to keep pushing forward. I’m going to do what I can to make this number go up.

You may see some extra debt in the coming month. All because of that lame ass moldy car…I got a rental ($500), paid for detailing ($560), and paid to have the sunroof fixed ($176). Thumbs down. I also paid for a personal care item that I would’ve normally paid for in December that cost $612. With that and everything I’m taking a bit from my savings for Amazon Prime ($149), my car insurance ($939), and my home warranty ($592), I didn’t want to drain my emergency fund completely, but I will be paying more than the monthly payment to get this balance down. I just couldn’t see it all go at once so I used debt to help me through a portion most of it.

Pro-Makeup Artist Tip

The biggest question we have to ask ourselves, is…is higher costing makeup more worth it? I can answer that question…maybe. LOL!!! I know I’ve done it again. It all varies. For me having a train case where I pay for everything, I do go cheaper on certain things like, eyeshadow, foundation, and concealer. The reason for this is because the base is the most important thing for your eye look, and I have found great inexpensive products that take place for foundation and concealer. For those less experienced, you have to test a few products out to find out what is going to be right for you. I can make the recommendation but I highly encourage you to do the research for products. Get samples from Ulta and Sephora if you can. That way you can try several products without busting you budget. 😊

That’s all I have for today! Don’t forget to like, comment, subscribe to see more content from me and to share my page with someone who you think may benefit from the makeup tips or financial advice.

Welcome new subscribers! As soon as I hit 100 subscribers, I’ll host a giveaway.

Until Next Time!

Photo by Sarah Kilian on Unsplash

Leave a comment