So we made it to the month of August somehow. I don’t know how this happened. I don’t know when it happened. Half of the year is all the way gone and time keeps moving on. Since we have no choice in the matter, let’s get this budget business out of the way. 😊 So pull up a seat, grab a snack, and something to drink and we’ll see how my last two weeks went and how my next two weeks will be planned.

I did sooooooooo great with this last paycheck!

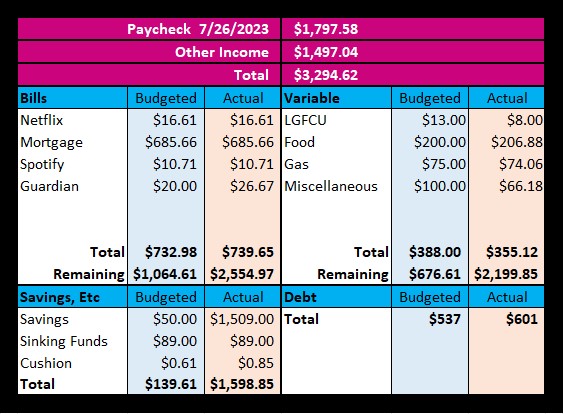

My income is much higher than it normally is because of selling my Nissan Rogue. That makes me super thankful for positive equity. The total for the sell of the vehicle was $1,448.44 plus my loan was paid off. The other items that I counted for income were $6.77 in rewards from Discover, $9.70 in interest in my high yield savings, $2.13 in interest for my checking account, and last $30 from a friend for doing a favor. As for my bills, everything stayed the same. My variable spending is where you’ll see the most changes. For LGFCU, I expected to pay $13 and only spent $8. For food, I expected to spend $200 and spent a little over budget at $206.88. For gas, the expected amount was $75 and I cut it really close and came in at $74.06. Lastly, for miscellaneous, I expected to spend $100 and spent $66.18 and this is where things made the biggest difference. Because of the check for selling my car and interest for my account, A total of $1,509 was put towards savings, I saved $89 towards sinking funds, and had a total of $.85 went towards my checking account cushion. After all of that, I expected to pay $537 towards debt but paid a total of $601. Fantastic progress for the pay period!

Now that the last paycheck for July is taken care of, let me show you all what I expect to pay for this pay period:

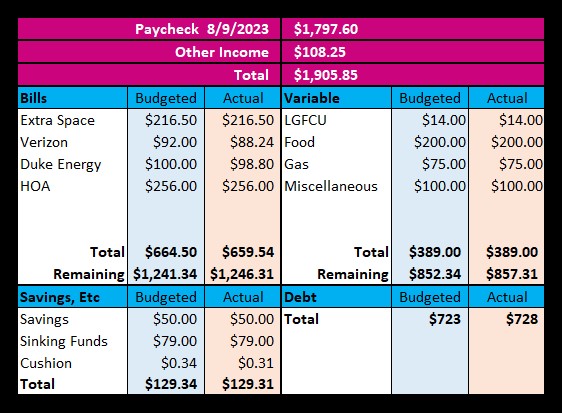

Originally, I have my car payment coming out on the 15th but that was removed and my first car payment for my new car is due next month on the 14th so I’ll be taking advantage of the “free payment” this month by…you guessed it, putting it towards debt! Other than that, my Extra Space rent is due in the amount of $216.50, Verizon has $88.24 due, Duke Energy has $98.80 due, and last my HOA is due for $256. My variable spending is set to $389, my savings set to $129.31 because I reduced it by $10, and last my debt! Because of Duke Energy and Verizon, the amount of debt I’ll be paying increased by $5 from $723 to $728. I like to break these payments up and made one on Wednesday and will make the next on 8/16.

Speaking of debt, Money Moves Monday had the wrong amount. I gave myself WAY more debt than I actually have. I forgot to remove my car payment from my debt totals. Do not be alarmed when the debt is a lot lower than what we discussed!

Pro-Makeup Artist Tip

While I wish everyone could wear winged liner, some of ladies have hooded lids that won’t accommodate this. If you’re eyes are so hooded that winged liner disappears, fake a wing with eyeshadow if you have a working knowledge of eyeshadow. This will elongate your eye and give you that coveted winged liner appearance. As you can see…all is not lost. 😊

That’s all I have for today! Don’t forget to like, comment, subscribe to see more content from me and to share my page with someone who you think may benefit from the makeup tips or financial advice.

Welcome new subscribers! As soon as I hit 100 subscribers, I’ll host a giveaway. Knowing how practical I am, it’s highly likely it’ll be cash.

Until Next Time!

Photo by Money Knack, www.moneyknack.com on Unsplash

Leave a reply to Brushes & Budgets Cancel reply