Here I am with another Debt Update! I plan on posting them every Monday…I might rename it Money Moves Monday but we’ll see! Anywho, I hope you have your snack and drink ready because we are going on with the updates!

March went extremely well! In addition to my regular income, I received a bonus at work, and a refund for state taxes. Again…April will NOT be as sexy as March was but I do expect to make some good progress. It’ll be more consistent to what I normally have going on. The topics I’ll be highlighting today are:

- My Income for March

- My Debt Totals

- My Net Worth

- Other Updates

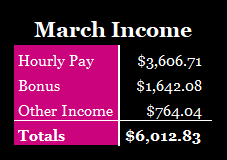

March Income

This is actually the first time I tallied everything so I’m a bit shocked it was this high. Naturally when I get paid, I pay myself first, I consider what my debt payments will be, and I keep an eye on everything.

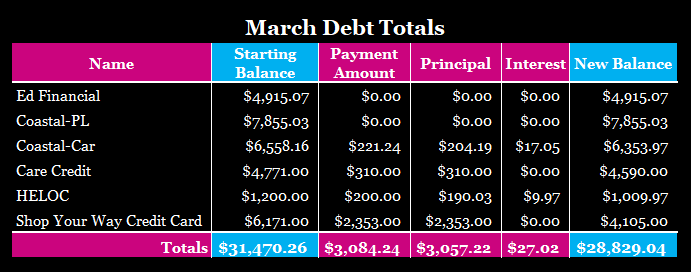

My Debt Balances – March

The loans that are first in line for payoff are at the lower portion of this list:

I made so much progress this month! When it comes to my income, 51% of it went to debt. I went ahead and bit the bullet and paid off my HELOC on April 1st. It will be included for the update for April.

Currently my debt totals for the month of April are:

- Credit Cards – $8,695

- Total Debt – $27,819.07

I’m starting the month off strong and am feeling good about it.

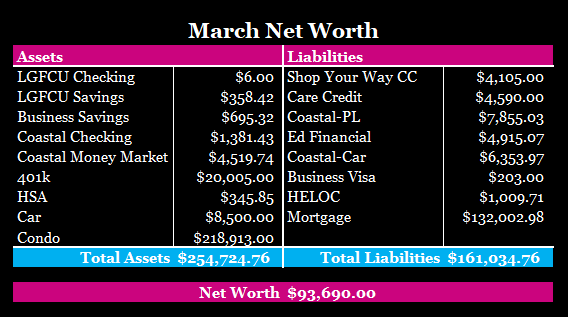

My Net Worth

I have been keeping track of my net worth since April 2022. It’s all about knowing where you stand. Just because you have debt doesn’t necessarily mean you have a negative net worth. This figure does change regularly. I’m going to guess it will go down by the end of April because I deducted cash from my Money Market.

I found that out when I started tracking, that the picture wasn’t as dreary as I assumed. Hence, why one should always get the figures down on paper. This helps prevent ass-umptions.

I keep track of everything I can to make sure I’m aware of what is happening on a month-to-month basis. I have around 10 spreadsheets I operate from daily.

Other Updates

As of right now, the insurance company is back to giving me the run around for the claim I made in January for TMJ. Things are still up in the air. I called back expecting to yell again because someone decided to deny one of the claims as a duplicate, *sigh* but the agent I reached was pretty amazing this time. If you ever have to get in contact with your insurance company, please don’t use their message center. Calling them will give you just a little more peace of mind. I’ll be checking back in about progress with the insurance company tomorrow to see if there is some sort of movement.

In the meantime, waiting for the TMJ claim to process, kind of derails things. I came up with a plan over the weekend, just in case they continue to be tools and not reimburse me for the portion they owe. It adds another 2 months on to my hopes at debt freedom. Sometimes the fight becomes exhausting after you’ve been doing it for too long. I’ll keep working on this one though. I let it slide when I had my breast reduction but not this time.

That’s is for the Debt Update for the entire month! I’ll catch you all next time!

Photo Credit: https://www.latimes.com/travel/story/2019-12-17/travel-fly-guy-for-december-22

Leave a reply to Brushes & Budgets Cancel reply